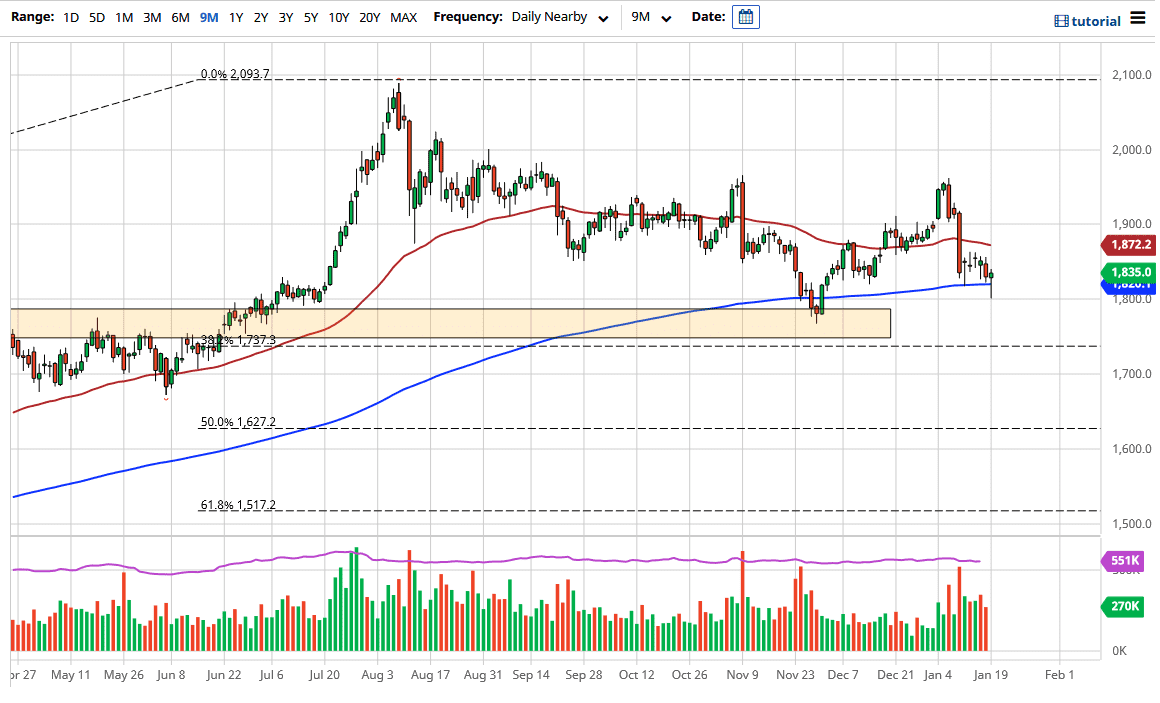

Gold markets pulled back a bit during relatively thin trading on Monday due to the Martin Luther King, Jr. holiday. After all, a huge portion of the volume comes out of the United States, so you can only read so much into the candlestick for the session. In fact, you can also make an argument that the original breakdown may have been done based upon relatively thin volume.

Gold markets have been battered as of late, but so far, we have been respecting the 200-day EMA as seen back in November. The fact that we formed a hammer is somewhat comforting for those who wish to be buyers of gold, but the biggest driver of gold in the short term is going to be the stimulus talks in the United States, and unfortunately that is a political debate. That means that the directionality of this trade will hinge upon the latest headline and tweet, but longer-term gold is still going to be very attractive due to the fact that no matter what happens next, stimulus is going to be huge and probably continue to come in the future as well.

In the short term, though, we could have a rush back towards the $1750 level. That is where we bounced from last time, and I would anticipate that there should be a significant amount of structural support in that area. However, if we can turn around and break above the 50-day EMA at the $1872 level, that opens up a move towards the $1900, followed very quickly by a move to the $1960 level. I do believe that longer term we will go higher, but you need to keep your leverage under control here because it is going to continue to be very noisy, to say the least. By keeping a small position, you will be able to ride out what will almost certainly be very noisy market over the next several weeks as we debate the size of the next stimulus package in America. Adding to a winning position to the upside is how I plan on trading this market, but patience will be needed more than anything else right now. As things stand currently, I have no interest in selling.