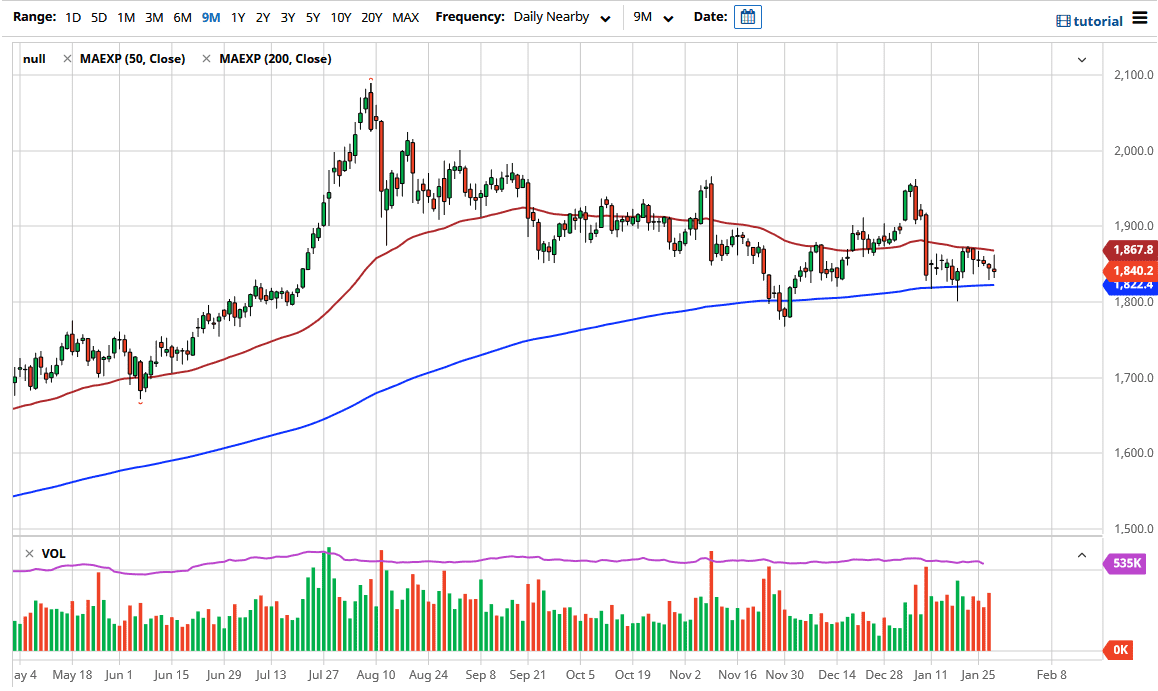

Gold markets initially tried to rally during the trading session on Thursday, but then ran into a bustle of resistance near the 50 day EMA. We have been all over the place during the trading session on Thursday, and I do think this shows just how much trouble gold finds itself in suddenly. That being said, I do believe that longer-term gold continues to find buyers, and most certainly by the end of the year I anticipate that we will not only reach the highs but break above there. This is mainly due to the idea of stimulus and a lot of financial and fiscal help coming out of governments thereby devaluing currencies in general.

To the downside, if we were to break below the 200 day EMA it is likely that we will see the $1800 level tested. The $1800 level is an area that is a large, round, psychologically significant figure, and an area where buyers have jump back in. I believe that support extends down to the $1750 level, but that being said I think what we are looking at a situation where buyers will continue to commit on the dips but there will be a lot of volatility that you need to pay attention to. Because of this, I would not jump in with a huge position, because on a day like the one we had on Thursday you could get rather spanked if you are careful.

That being said, if we can break above the 50 day EMA, then the market is likely to go looking towards the $1900 level. If we can break above there, then the market is likely to go looking towards the $1960 level. That being said, I think it is going to be very noisy on the way up there, and because of this I think that you have the ability and the time to simply add little bits and pieces along the way in order to build up a bigger position for once we finally do break out. The gold market is one that I have no interest in shorting, although I do recognize that it is struggling. That being said, pay close attention to the 10 year note, and the interest rate. If it continues to rise, that is toxic for gold.