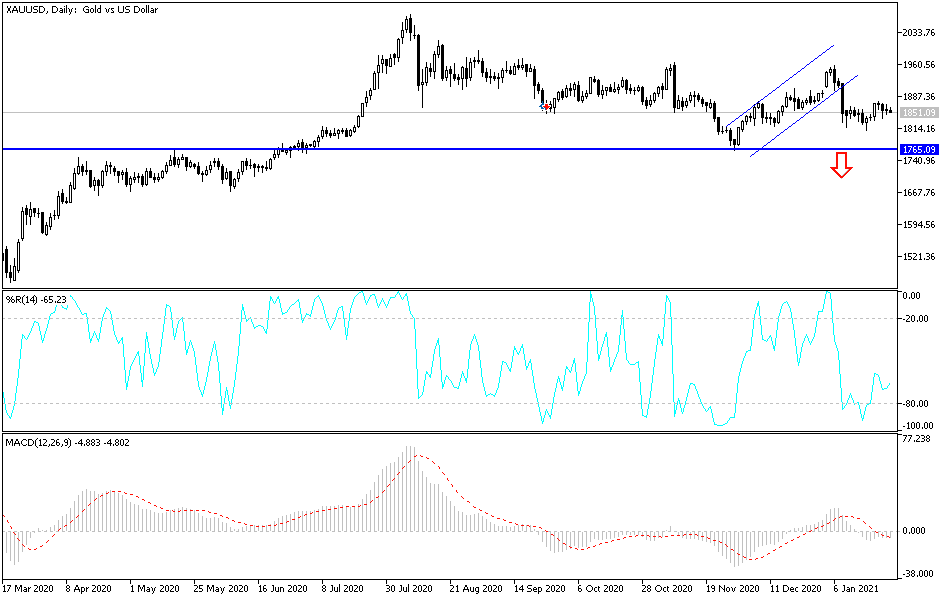

Gold markets fluctuated during the course of the trading session on Monday to kick off the week, as we sit below the 50-day EMA still. If we can break above the 50-day EMA, then it is likely that we could go higher, with the initial target being the $1900 level. A break above that level then opens up the possibility of a move towards the $1960 level, and then possibly back towards the highs of $2100.

To the downside, if we were to break down below the 200-day EMA at the $1821 level, we will then go looking towards the $1800 level, and then the $1750 level. I do believe that if we pull back from here, there should be plenty of buyers try to get involved, as almost everybody in the world is betting against the US dollar right now, which should continue to help the gold market if that remains the case. While the dollar and the gold market do not necessarily have to move in opposite directions, most of the time they will. There is the argument that when the “safety trade” comes back into vogue, both of them can rally.

Looking at this chart, the overall sideways action will continue in the short term, but we have a Federal Reserve meeting and announcement this week that will probably be what the market is waiting for. As soon as Jerome Powell makes it clear that he is not willing to do anything to lift the value of the US dollar or to interfere with Wall Street profits, the gold markets will more than likely rally from there. As the central bank takes its cues from Wall Street, and not necessarily the overall economy, gold will continue to flourish over the longer term.

In fact, it is not until we break down below the $1700 level that I would be concerned about gold from a longer-term standpoint. Until then, I still look at dips as opportunities to buy gold “on the cheap” and in small bits and pieces. I would not jump in with both feet in the short term, mainly because it is such a volatile market in general. I have no interest in shorting anytime soon and will either be flat or long.