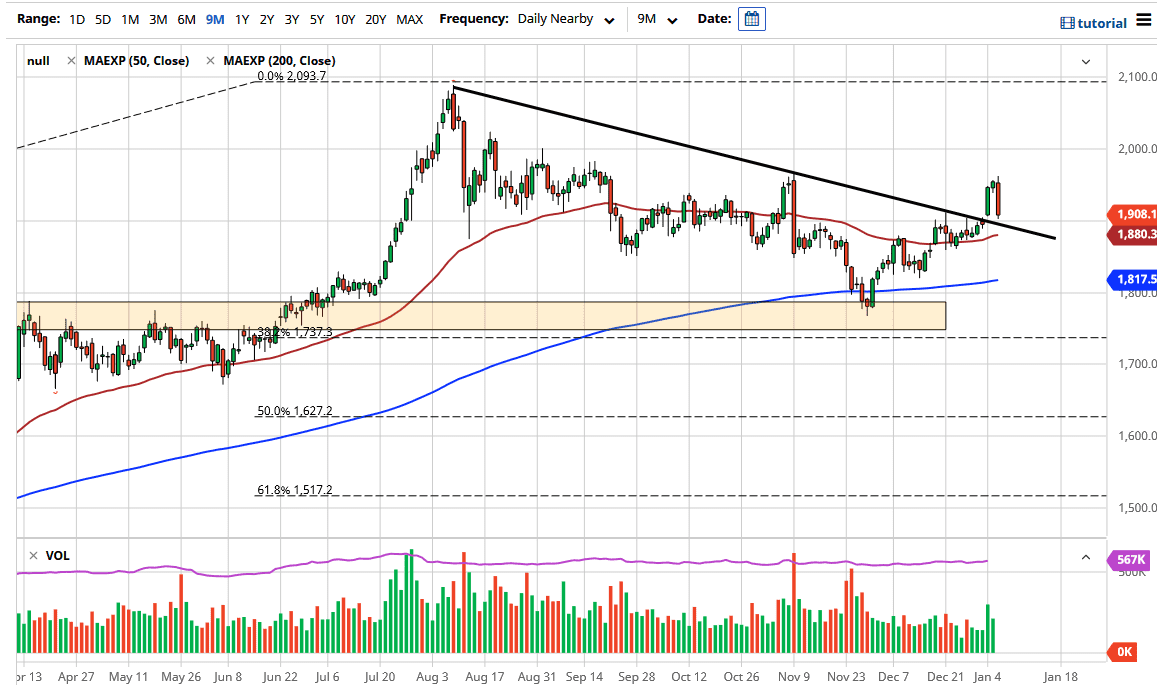

Gold markets fell during the trading session on Wednesday as the US dollar gained a bit. Most of this was due to an over-extension in gold to begin with, and the fact that the 10-year yield popped over the 1% level again, thereby taking away some of the attractiveness of holding gold. Long term, this will probably work itself out, but from a technical analysis standpoint, we find the gold market at a very interesting junction.

The previous downtrend line has been tested, and perhaps even more importantly, the gap at the $1900 level has been filled. It is only a matter of time before the buyers get involved, especially as the $1900 level is a large, round, psychologically significant figure, and then we have the gap and the 50 day-EMA coming into play right along with that trendline. In other words, this is a nice break out and a potential retest.

To the upside, I believe that we will go looking towards $1950 level again, and then eventually the $2000 level. The gold markets have a lot to work with, not the least of which is going to be the falling US dollar. Beyond that, one will have to see whether or not there are any shocks to the system, but at this point a lot of this will come down to stimulus and what happens with the US dollar going forward. It is worth noting that we are below 90 on the US Dollar Index and testing the 89.50 level. There is still a significant amount of support underneath there, so we may have more of a fight on our hands in gold than this chart suggests. Nonetheless, I have no interest in shorting this market, as it looks so well supported underneath and I think that we are in the midst of forming a large bottoming pattern. In fact, sometime later this year, I would anticipate breaking out to fresh, new highs in the gold market and reach above the $2100 level. I do not necessarily have a target, because I think this is more or less going to be a longer-term play and should be thought of more as an investment than anything else.