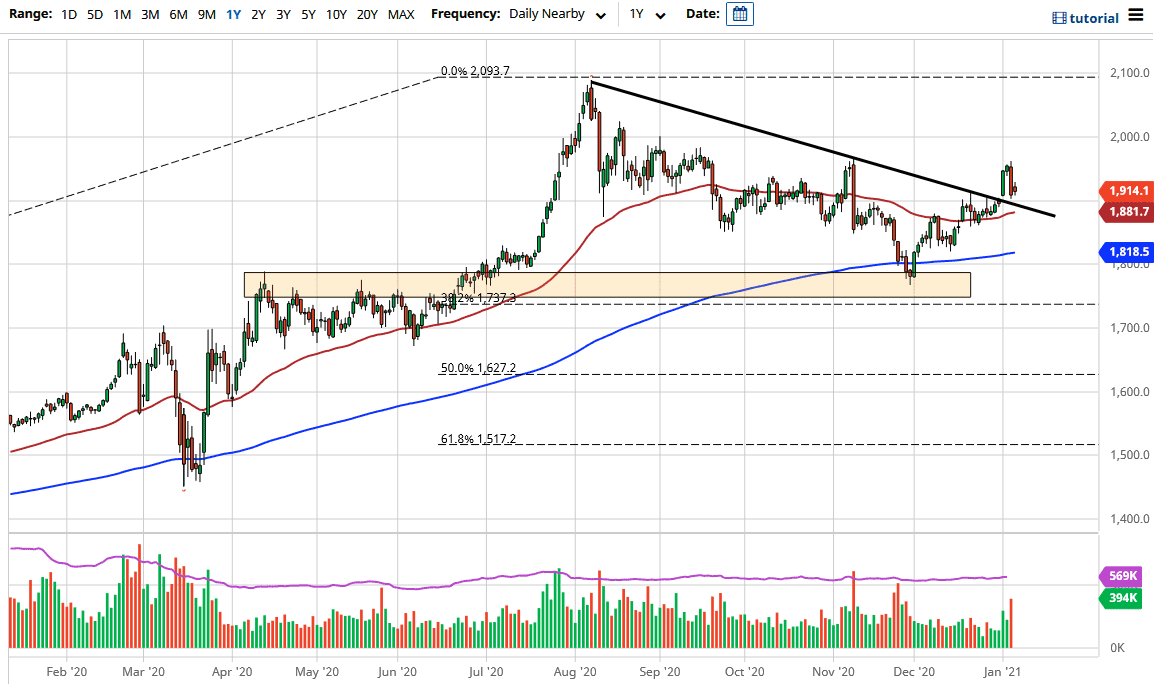

The gold markets have done very little during the trading session on Thursday as we await the jobs number for Friday. We are sitting just on top of a gap, which of course is an area that could offer a little bit of a support barrier. The $1900 level is significant from a psychological standpoint as well, but the fact that there is also a gap there, and of course a downtrend line also, then it means that we could see plenty of buyers in that general vicinity. At the very least it makes quite a bit of sense that there would be a lot of interest.

Going into the jobs number on Friday though, it is a bit difficult to get overly bullish or bearish about gold. We need to see the reaction to the jobs number before we put a lot of money to work. At this point, I think gold does look as if it is trying to go higher, but one of the biggest problems that we have right now is the fact that interest rates in the United States are rising. That does tend to replace some of the allure of gold in the short term, but longer-term there is still a lot of concerns about larger inflationary numbers.

Some models that I have seen run here as of late suggest that we could be looking at 3% inflation in the United States in the middle of the year. If that is the case, then we probably start to see the gold markets picked back up rather stringently. I think we are at an inflection point currently, with the technical analysis suggesting that we go higher but the fundamental analysis being a little bit murkier than that. Because of this, I would prefer to be on the sidelines and simply wait to see what happens on Friday as there will of course be a lot of volume and volatility thrown into the market in one shot. Having said all of that, if we break down below the $1850 level, then I think gold probably goes back to test the lows again over the last month or two. To the upside, the target of course would be $2000 followed by $2100 given enough time.