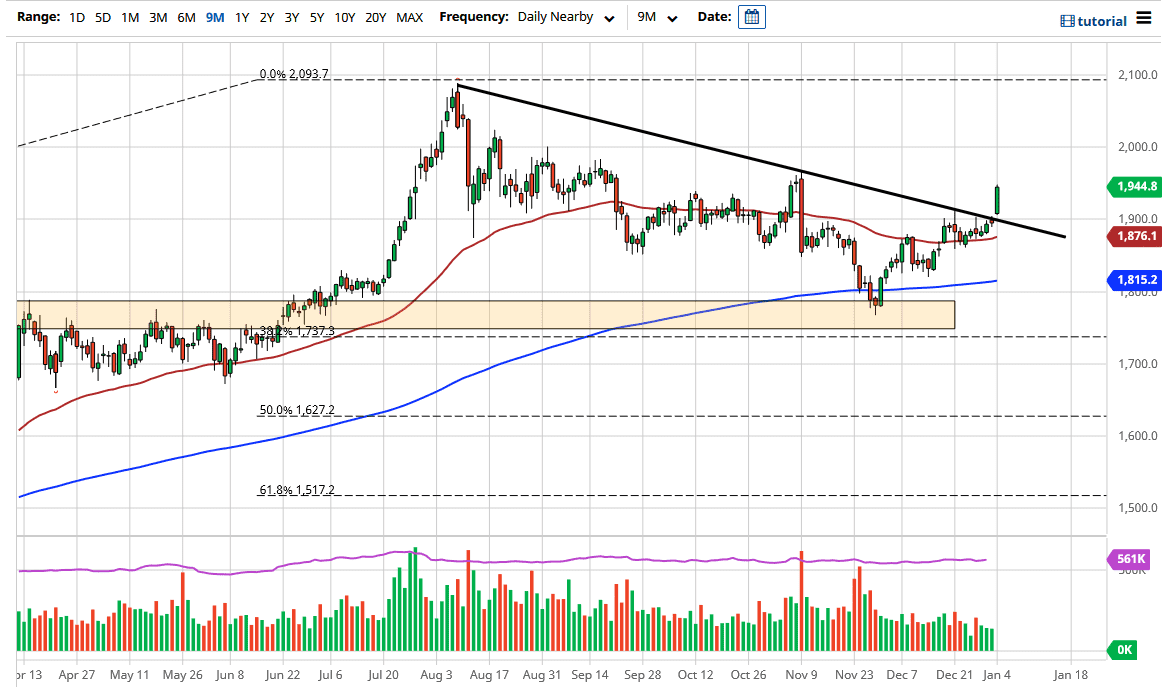

Gold markets have gapped higher to kick off the trading session on Monday and to start off the new year on the right foot. By gapping above the $1900 level, we have not only cleared a large, round, psychologically significant figure, but we have also jumped over an uptrend line. Both of these are very bullish signs and should continue to keep gold elevated going forward. There are a lot of concerns out there that could continue to drive gold higher, but something is a bit special about the next couple of days.

That “something” is found in the US State of Georgia. The polls in the Senate runoff races are starting to suggest that there is a real chance of the Democrats sweeping. If they win both of the Senate runoff races, then Kamala Harris as vice president would be the deciding vote in any Senate vote that went 50-50. In other words, it would essentially be a Democrat-run Senate, which means that spending would probably increase drastically. Furthermore, there are a lot of regulatory concerns for financial firms, and as a result, it could weigh heavily upon the US dollar. As a knock on effect, that should send gold markets higher in general.

If we pull back from here, the $1900 level should offer support, because - and let's not kid ourselves - gold has other reasons to go higher as well. Stimulus in the United States will be strong, even if the Democrats do not run all three branches of government. There is also a lot out there to be concerned about with global shutdowns, as the next few months should continue to be very difficult economically. In other words, there is a bit of a safety trade to be had in the gold market as well. Also, it is important to understand that central banks around the world continue to be very loose with monetary policy, not just the Federal Reserve. It is about wealth preservation and risk appetite. Pullbacks will continue to attract a lot of attention, and it is worth noting that we shot almost straight up in the air towards the $1950 level, an area that I suggested could be a target. Longer term, we will go back towards the highs.