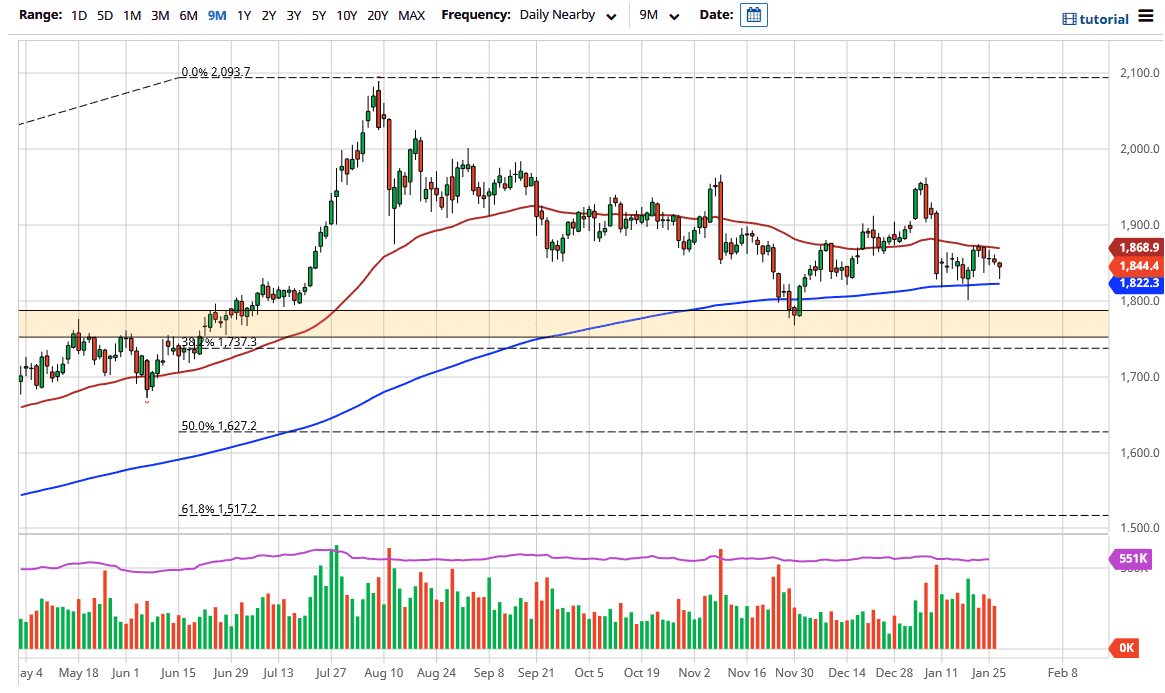

Gold markets have plunged initially during the trading session on Wednesday as yields in the 10 year note skyrocketed. However, they have since abated and gold has recovered as a result. The 200 day EMA continues offer support and we have formed a hammer. The hammer of course is a bullish sign and if we can break above the top of it the market would probably go looking towards the 50 day EMA. That currently resides at the $1860 level, and if we can break above that level, then it is likely that we go looking towards the $1900 level.

I do believe that eventually the gold markets will rally rather significantly, especially as central banks around the world continue to flood the markets with so much in the way of liquidity. The 200 day EMA of course offers a nice technical indicator to pay attention to, but we also have much more in the way of structural support at the $1800 level. Because of this, I think that what we are going to see here is more of a base building exercise as we have been doing over the last couple of weeks. Yes, we did have a significant amount of selling a couple of weeks ago, but you will notice how we have just simply been going sideways and killing time since then. That is a good look and does suggest that we will eventually get back up on our feet.

Pay attention to the US dollar, because it obviously has a significant influence on gold as well, as there does tend to be a bit of an inverse correlation due to the interest rates in America. Given enough time, I do believe that gold goes to the $2100 level, but we are multiple areas between here and there that would have to be conquered before we can get to that point. In other words, I still favor a “buy on the dips” type of strategy but I also recognize that it is going to be very noisy and difficult at times. Because of this, I am slowly building up a longer-term position and therefore not jumping in right away with my usual size. Patience and caution are probably the two most important words I can think of right now.