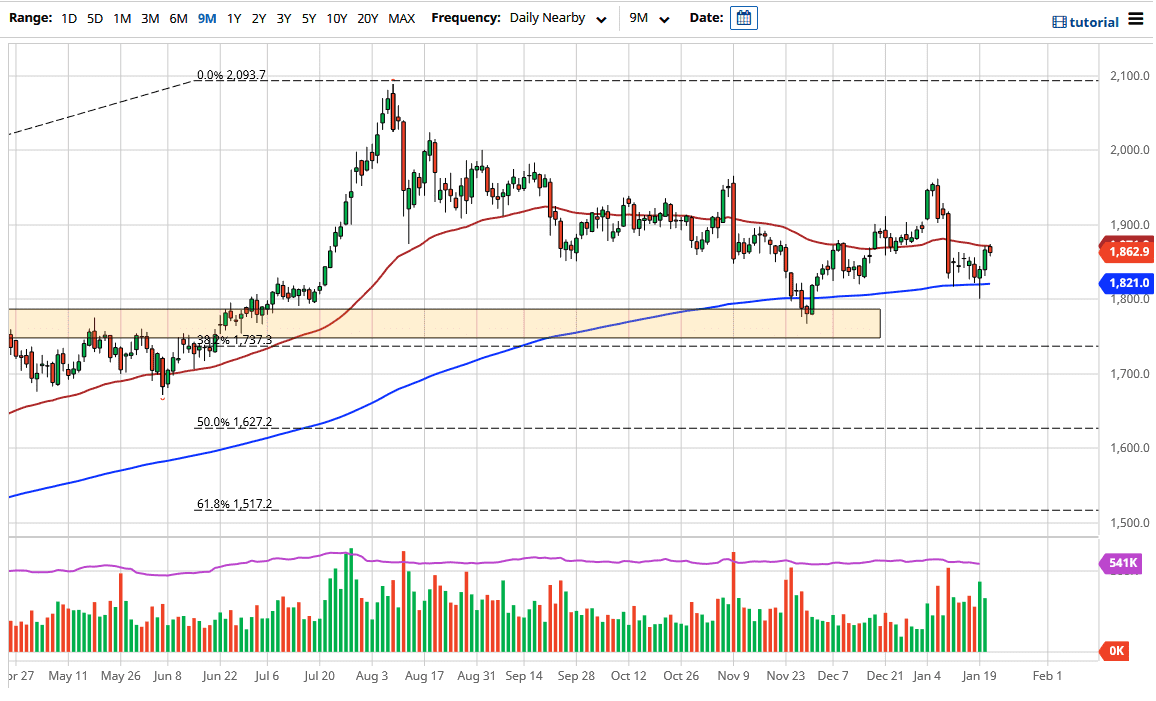

Gold markets pulled back just a bit during the trading session on Thursday but still looks somewhat bullish and it certainly looks as if it is trying to build some type of base. This is all based upon stimulus of course, and the idea that central banks around the world are going to continue to flood the markets with cheap currency. As they devalue fiat currency, that drives up the demand for precious metals and “things.” Gold is certainly one of the first places that people will be running towards, but it should be noted that during the day on Thursday Mitt Romney and Lisa Murkowski both suggested that they are not necessarily looking to get into some type of big rush to do stimulus in the US Senate. In other words, stimulus may be on hold. At the very least, I do not think that Joe Biden get his $1.9 trillion package.

This makes an interesting argument for reevaluating the gold situation. From a technical analysis standpoint, it certainly looks as if it is trying to build a base. And do not get me wrong, the US dollar can strengthen while gold does the same, although the typical correlation is that it is negatively correlated. If you look at the past, we have seen both of these markets move higher. That being said, a lot of what we see in gold is going to be based upon the latest tweets and comments from politicians involving stimulus, so this means that the market is probably going to be held hostage.

I believe that we continue to see a lot of choppiness, but I would not dissuade anybody for buying little bits and pieces on the way up every time we pull back. If we do break down below the $1750 level though, that could be very bad for gold, and this will be especially true if we continue to see interest rates rise in the 10 year note. Confused yet? Well good because that is essentially how all this ties in together and you have to watch all of these markets at the same time in order to triangulate where we are going next. All things being equal if you simply look at a chart it suggested could go higher, but you could have said that multiple times in the past just as you could have said a couple weeks ago it looked like it was going to fall through the floor. Remember, gold is heavily influenced by multiple markets and of course risk on/risk off sentiment.