Despite the recovery of the US dollar, gold has tried to maintain its gains around the level of $1865 since the start of this week, pending any new COVID-19 or stimulus developments. In general, gold futures struggled to confirm the trend in a choppy trading session for the last week of January. The gold price cannot generate momentum amid the dollar's strength and ahead of the US Federal Reserve policy meeting. With the possibility that the Fed will maintain its pessimistic tone, the federal government will start working on a new stimulus bill, which could determine the direction of the gold price in the next month.

Gold witnessed a weekly increase of more than 1%, although it decreased by 2.3% in the first weeks of 2021. In the same performance, silver, the sister commodity of gold, decreased, and silver futures fell to $25.43. Silver rose 2.7% last week, but has also declined roughly 4% since the start of the year.

In general, precious metals were affected by the rise in the US Dollar Index (DXY) to the level of 90.45. A strong dollar is considered a bad thing for commodities that are pegged to the dollar, because it increases the cost of buying them for foreign investors. In early trading this week, Treasury bonds were also in focus, with the bonds falling. The benchmark 10-year bond fell 0.045% to 1.046%. The one-year bond was unchanged at 0.094%, while the 30-year bond fell 0.054% to 1.802%.

The Fed will complete the two-day Federal Open Market Committee (FOMC) policy meeting on Wednesday. The Fed is widely expected to leave US interest rates unchanged at 0.25%. Policymakers are also expected to maintain a dovish tone and provide an update on the US economy. Market analysts believe that the Fed will encourage more fiscal stimulus to support the economic recovery.

Gold markets are also waiting for the latest GDP data to provide a glimpse into the world's largest economy.

Relative to other metal commodity prices, copper futures rose to $3.6275 a pound. Platinum futures fell to $1103.90 an ounce. Palladium futures fell to $2,340.50 an ounce.

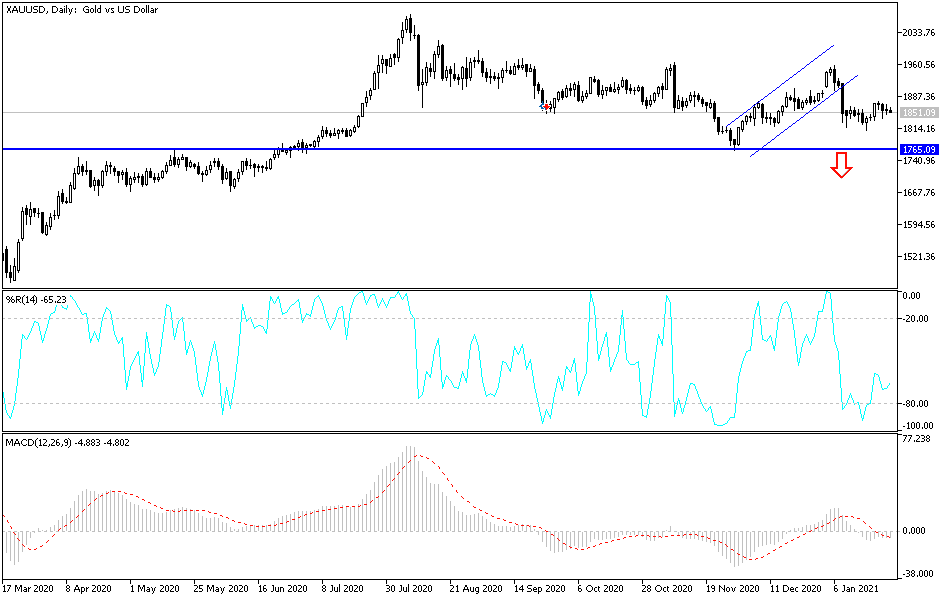

Technical analysis of gold:

On the daily chart, the price of gold has been moving in a limited range for several trading sessions in a row, paving the way for a strong movement to come. The closest support levels are $1839, $1820 and $1800. On the upside, bulls are still looking towards the psychological resistance of $1900 to control performance long term and short the market. All in all, I would still prefer to buy gold from every downside. The price of gold will be popular with investors in the event of an economic decline, as the COVID-19 epidemic is still present, and stimulus plans and global efforts to eliminate it may take more time.