The price of gold had a good start to 2021 after posting its best annual gain in a decade. Gold prices rose above the psychological resistance level of $1900 with gains that pushed it to the resistance level of $1955, its highest level in nearly two months, as weakness in the US dollar contributes to gold's upward momentum. Real yields - the difference between nominal benchmark bond yields and the rate of inflation - fell near their lowest point last year on Friday, boosting bullion's appeal. This decline was driven by rising inflation expectations, as markets bet on distributing the vaccine, additional global central bank support and continued government aid.

"Investors are looking for assets that benefit from rising inflation," said Giovanni Stonuovo, an analyst at UBS Group AG, in an interview with Bloomberg. "The deflation component supports gold, too."

Meanwhile, the greenback continues to fall after declining for three quarters, and the US Dollar Index has collapsed to its lowest level in two-and-a-half years, making bullion cheaper for holders of other currencies. Gold is also supported by renewed flows to ETFs, after withdrawals in November and the first weeks of December. Accordingly, Jeffrey Sica, Founder of Squared Alternative Investments, told Reuters, "There is a possibility that we will see a major stimulus that will lead to a further decline in the dollar."

Investors' attention has been on Tuesday's run-off Senate elections in Georgia, which will determine which party controls the Senate. "This week's Senate elections could turn into a major disruption event, so gold will rise because of that," added Sika. A Democrat victory in these elections would mean that Democrats control all three houses of the United States government.

Nonprofit bullion is widely seen as a hedge against inflation and currency depreciation that is likely to result from large stimulus measures.

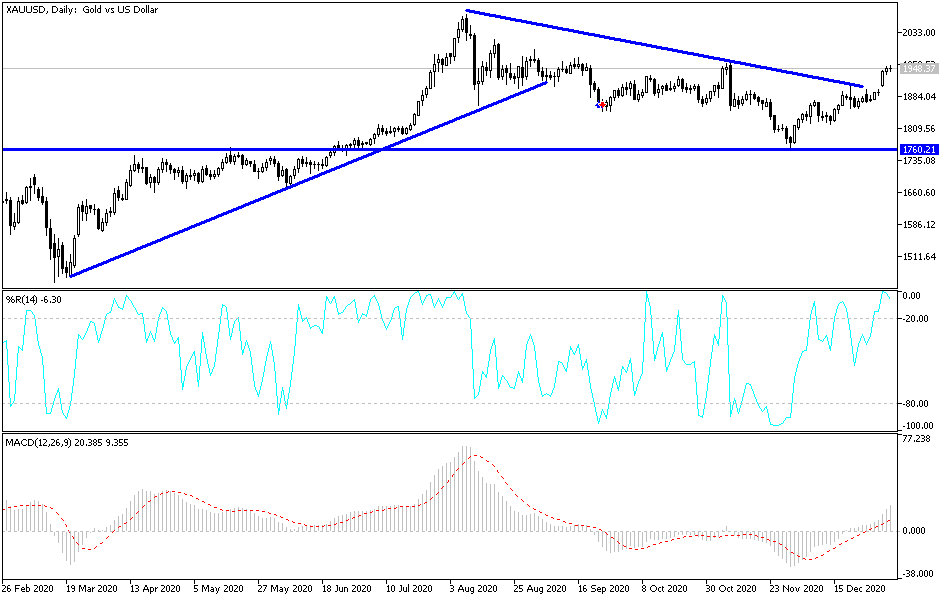

Technical analysis of gold:

The stability of the price of gold above the psychological resistance of $1900 still supports the strength of the bulls' control over the performance. The pair could reach overbought levels, leading to profit-taking sell-offs. The closest levels of resistance are now $1955, $1972 and $1990. On the downside, according to the performance over the same period of time, the reversal of the trend will be by breaching the support level of $1916.

In addition to the extent of investor risk appetite, the price of gold will interact today with the announcement of the Service PMI reading for global economies, as well as the ADP reading to measure the change in US non-agricultural jobs and the content of the minutes of the most recent meeting of the US Federal Reserve.