The recovery of the US dollar did not prevent gold from achieving gains at the resistance level of $1871 as of this writing. Gold prices rose amid growing hopes that the new US administration headed by Joe Biden will agree to additional stimulus sometime soon to bolster the economic recovery and counter the effects of the coronavirus. Gold futures ended trading at the highest close in about two weeks. In the same performance, silver futures closed higher at $25.766, while copper futures settled at $3.6415. At the beginning of this week's trading, the price of gold fell to its lowest level in 6 weeks at $1805 before quickly bouncing back. The strong US dollar, as well as the uncertainty Biden’s $1.9 trillion stimulus program, appear to be major factors.

Market sentiment is tilted towards the warning side after US stocks tumbled from current highs despite strong recent gains. As the US markets were closed for a public holiday, less liquidity conditions exacerbated price volatility as the US dollar rebounded and focused more on the inauguration of the US President.

Biden, who was sworn in as the 46th President of the United States of America, called for additional stimulation and acceleration of the introduction of a vaccine for the coronavirus, which helped offset concerns about tax increases and increased regulation under a Democratic administration. Prior to that, US Treasury Secretary Janet Yellen pledged to "work hard" on stimulus to revitalize the economy affected by the coronavirus pandemic.

A report from the National Association of Home Builders showed an unexpected drop in US homebuilding confidence in January. The report said the NAHB/Wells Fargo Housing Market Index fell to a reading of 83 in January after falling to 86 in December. The continuing downturn surprised economists, who expected the index's reading to remain unchanged. With the unexpected decline, the Housing Market Index fell again from a record high of 90 in November.

Inflation levels in the Eurozone remained stable at their low levels, unchanged as expected, and thus they are still far from the goal of the European Central Bank, which will announce its monetary policy decisions on Thursday, after which there will be a press conference by the bank’s governor, Chrisitine Lagarde.

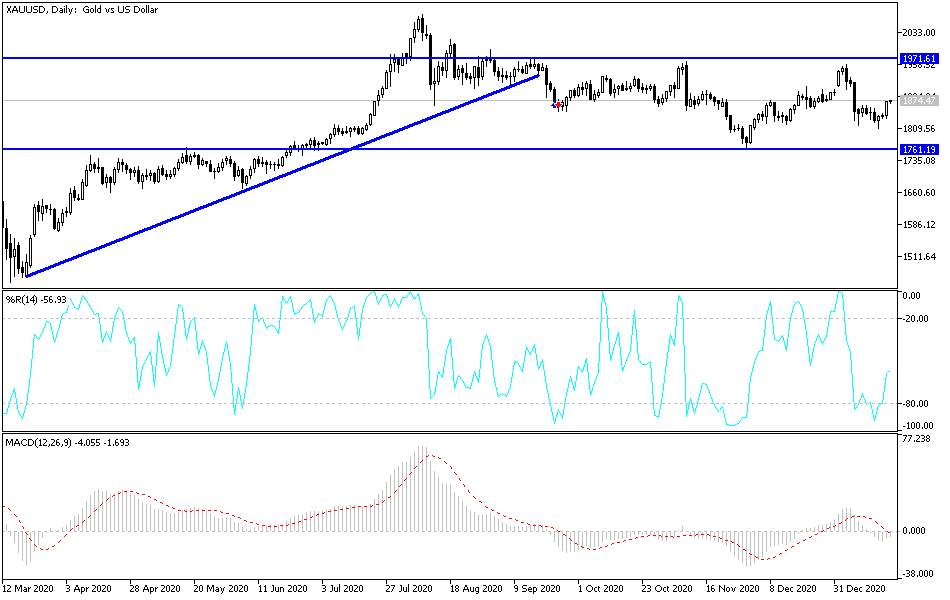

Technical analysis of gold:

According to the performance on the four-hour time chart, the price of gold has formed a new bullish channel that will be strengthened by moving towards the psychological resistance level at $1900. After the recent gains, some technical indicators began to sound alarms to move towards overbought levels. On the daily chart, bulls still need to break through the $1900 resistance level in case they want to be able to strengthen performance and thus increase buys. With the new US administration and the calming of investor anxiety, we expect that any gold gains will be an opportunity to sell again. The closest resistance levels are now $1882, $1890 and $1915. In return, selling will increase strongly if the price of gold returns to breach the support of $1810.

In addition to the extent of investor risk appetite, he price of gold will interact with the USD, the release of Australian employment numbers, the monetary policy announcement of both the Japanese central bank and the European Central Bank, and US economic data.