Despite the recent recovery of the US dollar, the price of gold moved upward towards the resistance level of $1945 an ounce, amid a price gap from last week around the $1893 level. Global restrictions to contain the new strains of the coronavirus have motivated investors to flee more towards safe havens, and gold is the most important of them.

The UK's National Health Service (NHS) has started rolling out the Oxford University vaccine developed by AstraZeneca to protect against COVID-19. Six hospitals in England will treat the first 530,000 doses of the vaccine.

The passing of the US coronavirus stimulus bill created downward pressure on the dollar, while enhancing the attractiveness of commodities. Investors are awaiting Tuesday's run-off election results in the US State of Georgia, which will determine control of the Senate. The minutes of the December Fed meeting will be released on Wednesday, as investors search for new guidance on asset purchases.

Gold rose more than 1% yesterday to a 7-week high after surpassing the strong chart resistance of $1.910. The deteriorating situation of the covid-19 virus around the world also fueled hopes for additional financial and monetary support, which led to a rise in cryptocurrencies and precious metals on the first trading day of 2021.

The US Dollar Index and gold prices have historically shown a negative correlation, with a correlation coefficient of -0.79 in the past 12 months.

The United States of America recorded 291,384 daily coronavirus cases on January 2, while Tokyo is also planning to announce a closure with the resurgence of new infections that put pressure on the health care system. Last week, President Trump signed $2.3 trillion in US stimulus aid, which included $900 billion in coronavirus aid and $1.4 trillion in government spending. Accordingly, it appears that gold, along with cryptocurrencies, is riding the back winds of this stimulus, and it also seems that the Federal Reserve will maintain a policy that is largely accommodative to the outbreak of the COVID-19 pandemic.

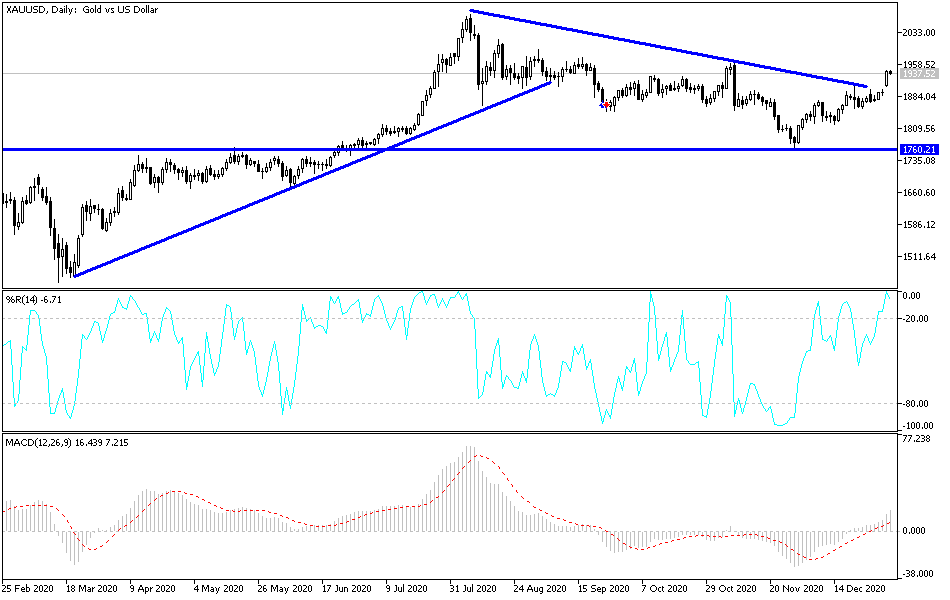

Technical analysis of gold:

Gold has broken through the descending channel and formed an ascending channel. Prices have already formed successive lows in December - an encouraging pattern that indicates a trend reversal in the potential medium term. Therefore, a breach of the key resistance at the $1.910 Fibonacci (61.8% retracement) level may open the door to go looking towards the $1940 Fibonacci level (50% retracement level), and then to $1965.

IGCS shows that individual gold investors are strongly bullish with 80% of net longs monitored, while 20% still favor selling. Investors have added + 6% while cutting the sale (-7%) recently. Amid an empty economic calendar today, the price of gold will interact strongly with the extent of investor risk appetite.