By the end of last week’s trading, the price of gold had plummeted to the support level at $1824 after several failed attempts by the bulls to break through the top of the resistance at $1864. The strength of the US dollar had the greatest impact on the decline of gold. Gold's gains prior to that were supported by US President-elect Joe Biden's announcement of a $1.9 trillion stimulus package proposal and the cautious outlook for the US Federal Reserve Bank for next year. Risk sentiment has been weakened by concerns about soaring cases of coronavirus in Europe and China, tightening lockdown restrictions in several cities around the world and heightened tensions between the United States and China.

Amid a rapid outbreak of the coronavirus, several countries around the world tightened lockdown measures. France has strengthened border control and extended curfews across the country to combat the virus. China has also placed millions of people on lockdown in response to a new outbreak of COVID-19 in the north and northeast.

Data from the US Commerce Department said that US retail sales fell -0.7% in December after falling a revised 1.4% in November. Economists had expected retail sales to come in unchanged compared to the original 1.1% decline in the previous month. Also, the US Labor Department said that the Producer Price Index for final demand rose 0.3% in December after a slight increase of 0.1% in November. Economists had expected production prices to rise by 0.4%.

The Federal Reserve Bank of New York revealed in a report that activity in the New York manufacturing sector unexpectedly grew at a slower pace in January. The Federal Reserve Bank of New York said its General Business Conditions Index fell to 3.5 in January from 4.9 in December, although a positive reading still indicated growth in regional manufacturing activity. Economists expected the index to reach a reading of 6.0.

Gold and silver prices tumbled against the strength of Bitcoin and the US dollar. The price of gold has been abnormally weak despite the strong dollar's weakness over the past several months. It appears that precious metals are in appropriate corrective stages within the bullish market. Therefore, this is good for gold and silver levels, as these types of stages are in constant directions that usually lead to strong growth.

In the short term, after the previous week's decline, gold is being sold at the 200-day simple moving average. A retraction in removing this ledge could lead to a horizontal cycle that indicates we may observe more contraction in the future. Silver looks similar to gold, as it is likely to imitate a similar fate.

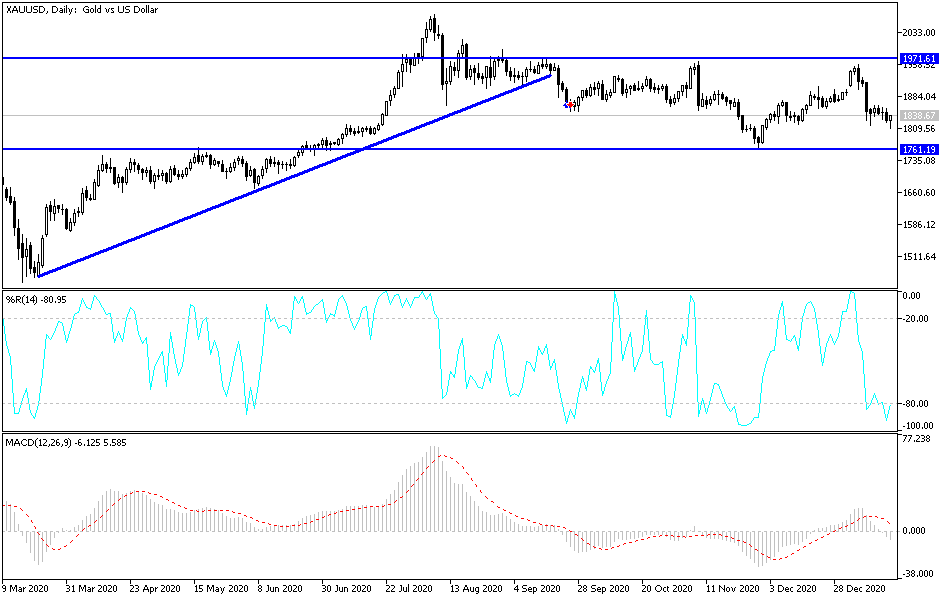

Technical analysis of gold:

According to the performance on the daily chart, gold has abandoned its ascending channel, which had brought it towards the resistance level of $1960 an ounce. After recent sell-offs, the strongest and important support and buying levels are currently $1810, $1785 and $1760. I still prefer to buy gold from every dip. Concern about the coronavirus and its gloomy impact on the global economy, despite the arrival of vaccines, will support the return of investors' appetite for buying goldas a safe haven. On the upside, I still see that the level of psychological resistance at $1900 is the most important for the bulls to control the general trend again.

As today is an American holiday, investor risk appetite will have the biggest impact on gold.