In the last hours of 2020 trading, the price of gold received support from investors abandoning the US dollar, which usually has a negative correlation to the yellow metal. The price of gold closed in 2020 trading higher, around the psychological level of $1900 dollars an ounce. During the year, the gold price had risen to the historical resistance level of $2075 per ounce, its highest ever. The year 2021 began trading with a bullish price gap to 1925 dollars an ounce.

The price of gold received additional support from an increase in cases of coronavirus infections and concerns about the economic impact of tightening restrictions in many countries. Although many countries have started administering coronavirus vaccines, concerns about a new strain of the virus, first noticed in the United Kingdom, have affected risk assets, prompting investors to search for safer options.

Gold gained nearly 25% in 2020, its best annual return in ten years.

Silver futures contracts ended 2020 trading lower at $26,412 an ounce, while copper futures settled at $3.5190 per pound. In general, silver prices have increased by about 50% in 2020.

Data released by the US Labor Department showed a slight decrease in US unemployment claims in the week ending December 26th. The report said initial jobless claims fell to 787,000, down 19,000 from the previous week's revised level of 806,000. Economists had expected unemployment claims to rise to 833,000 from the 803,000 claims originally reported in the previous month. Meanwhile, the report stated that the less volatile four-week moving average rose to 8,36750, an increase of 17,750 from the previous week's revised average of 819,000.

Most economists expect the US economy to recover at some point in 2021, but that depends on the US response to the pandemic. “While the outlook for the economy later in 2021 is optimistic, the economy and the labor market will have to traverse some tough terrain from time to time, and we expect the (unemployed) claims to remain,” said Nancy Vanden Houten, chief US economist at Oxford.

The latest jobless claims report showed that the two unemployment aid programs that were renewed through mid-March with a new virus relief package of $900 billion remained at high levels.

Unemployment assistance programs totaled 19.6 million for the week ending December 12, down 799,841 from the previous week. Analysts said that this drop represents some people who were able to find work, but many more have exhausted their benefits.

While the job opportunities for 2021 are brighter, it will take until the second half of 2021.

This week, the US government will release the country's December unemployment figures. Economists at JP Morgan expect the US unemployment rate to remain at 6.7% in December after falling in November, but predict 25,000 layoffs. It would be the first setback in monthly job growth since the economy began emerging from the recession caused by the virus last spring.

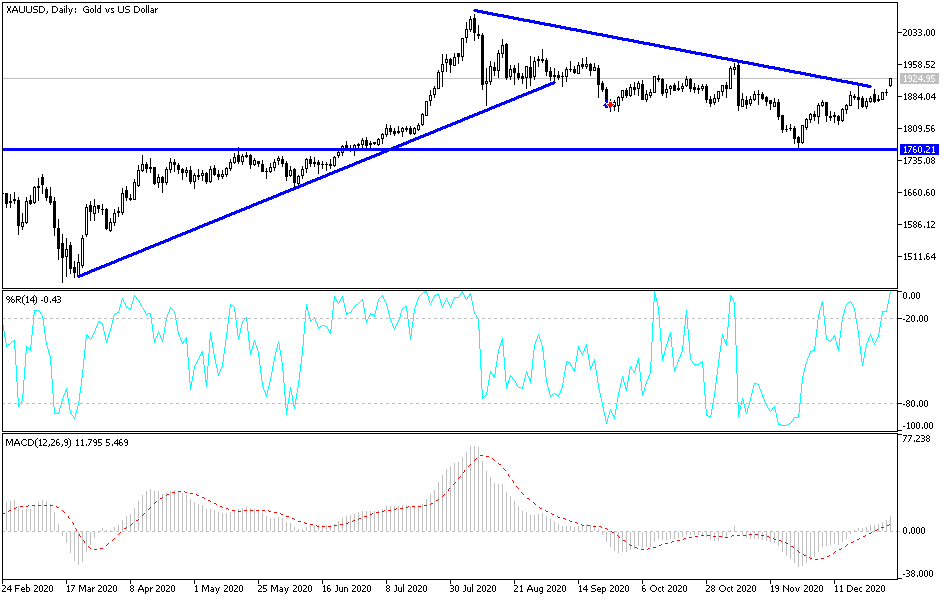

After the meteoric rise in gold prices during the first three quarters of 2020 (a rise of + 24.1% from January 1 to September 30), gold prices fell in the fourth quarter of 2020, after losing about -1%. Gold in the first quarter of 2021 is still bullish, but there are some challenges, and gold may not be the best-performing metal.

With the continued decline in the government deficit and interest rates, and with the global economy looking forward to post-pandemic growth, it is likely that silver will perform better than gold in the next few months. Buyers should not be surprised if platinum, along with base metals such as copper, nickel and iron, outperform gold prices in 2021. Significant support is still provided by governments and global central banks.

Technical analysis of gold:

Breaking through the psychological resistance of $1900 is important for the bulls' control. Stability above this resistance will increase buying pressure and the price of gold will move towards the nearest peaks of $1915, $1927 and $1955, respectively. On the downside, according to the performance on the daily chart, the movement of gold below the support level of $1850 ends the current bullish outlook and begins the domination of bears. All in all, I would still prefer to buy gold from every downside.

In addition to the extent of investor risk appetite, the price of gold will be affected today by the announcement of the Manufacturing PMI readings in Japan, China, the Eurozone, Britain and the United States.