Sell-offs pushed gold towards the $1838 support level before it recovered amid cautious trading during Tuesday's session around $1855, as of this writing. The market will be monitoring the reaction of the US dollar to the US Federal Reserve policy announcement later today. Overall, a weaker dollar limited a stronger downward slide for gold. Accordingly, the four-session losing streak is the longest for gold futures since April 2020. The US Dollar Index fell to the level of 90.12 amid increasing tensions between the United States and China.

Silver futures closed higher at $25,538 an ounce, while copper futures settled at $3,6195 a pound.

US President Joe Biden said he is open to negotiations regarding his $1.9 trillion COVID-19 stimulus bill. US Senate Majority Leader Chuck Schumer said that the aid package is unlikely until mid-March, when unemployment benefits from the last package are exhausted. Accordingly, a number of Senators from the Republican Party expressed their doubts about the need for additional incentives after the recent approval of a $900 billion relief package.

A report showed an unexpected improvement in US consumer confidence in January. The index rose to a reading of 89.3 in January from a revised 87.1 in December. Economists had expected the index to decline to a reading of 88.5 from the 88.6 originally announced for the previous month. The unexpected rebound came in the main index as the Expectations Index jumped to 92.5 in January from 87.0 in December.

Despite the continuing outbreak of the epidemic, the International Monetary Fund has predicted that the spread of COVID-19 vaccines will lead to a stronger global economic recovery in 2021. After falling by 3.5% in 2020, the worst economic recession since World War II, the IMF expects the global economy to grow 5.5% this year. The new figure for 2021 is an upgrade from the 5.2% growth the International Monetary Fund projected in October, and will mark the fastest year of global growth since the 2010 setback from the financial crisis.

Therefore, vaccines must slow the spread of the virus and allow governments around the world to ease lockdowns and encourage a return to normal economic activity. The global economy also got a boost from government stimulus programs late last year in the United States and Japan.

But the International Monetary Fund also says that economies around the world will need support from their governments to offset the damage from the pandemic, and warns that coronavirus cases and strains could cast a shadow over global health outlook and economic growth.

Commenting on this, Gita Gopinath, chief economist at the International Monetary Fund, said at a press conference on Tuesday: "Much depends on the outcome of this race between the mutated virus and vaccines and the ability of policies to provide effective support until the epidemic ends. So there is still an enormous amount of uncertainty.”

In an update to its global economic forecast, the International Monetary Fund said it expects the US economy - the largest in the world - to grow 5.1% this year after collapsing by 3.4% in 2020. China is expected to record the second largest economy in the world at 8.1% after that, having achieved an increase of 2.3% in 2020.

The International Monetary Fund also says that the Eurozone will record a 4.2% growth this year after it witnessed an economic growth of 7.2% in 2020. The Japanese economy is expected to grow by 3.1%, reversing a decline of 5.1% in 2020. Thanks to a faster-than-expected recovery in its factories and farms, the Indian economy is expected to grow by 11.5% in 2021, which is the fastest among the major economies, and a reversal from a decline in 2020 of 8%.

The agency also expects a rebound in global trade this year. It posted growth of 8.1%, after declining 9.6% last year.

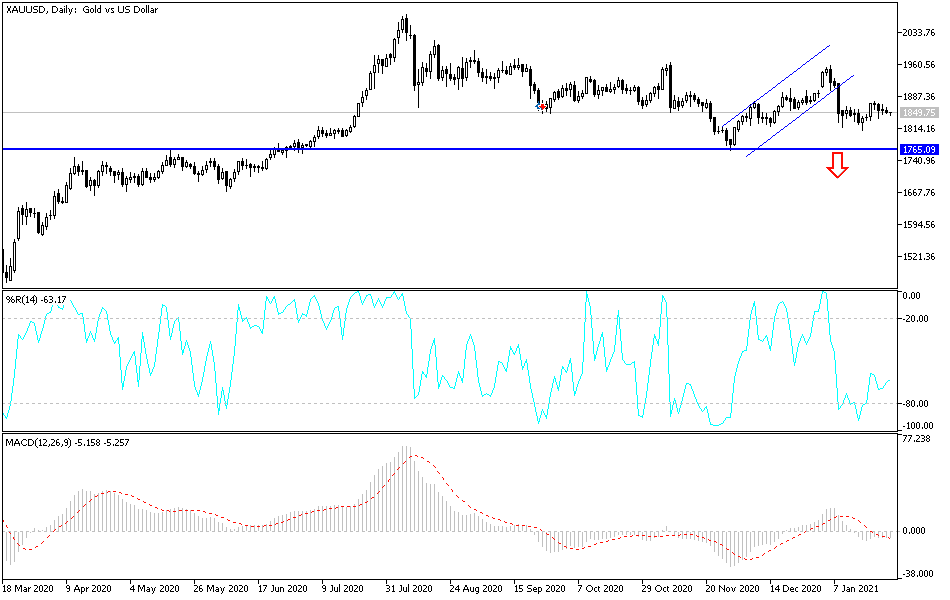

Technical analysis of gold:

On the daily chart, the price of gold may decline further if the $1838 support level is breached, possibly down to the the psychological support of $1800. At the same time, it will be an opportunity for gold investors to consider buying in preparation for a rebound. However, the COVID-19 pandemic and its effects will support the continued demand for gold purchases at every downward level. On the upside, bulls are waiting to break through the psychological resistance of $1900, and this may happen if the US dollar suffers a setback.

The price of gold will interact today with the market’s reaction to the US Federal Reserve’s monetary policy announcement and the comments of Governor Jerome Powell.