The NASDAQ 100 did rallied significantly during the trading session but has given up quite a bit of the strength during the day. That being the case, the market continues to see a lot of concern out there on a whole slew of issues. Not the least of which would of course be the nonsense going on with various options. At this point, it looks as if we are trying to figure out what to do next and as the wrecking ball of retail traders go ripping to the markets, there are a lot of traders out there that will need to cover losses by selling some things that they have made money in. In other words, this is an absolute mess just waiting to happen.

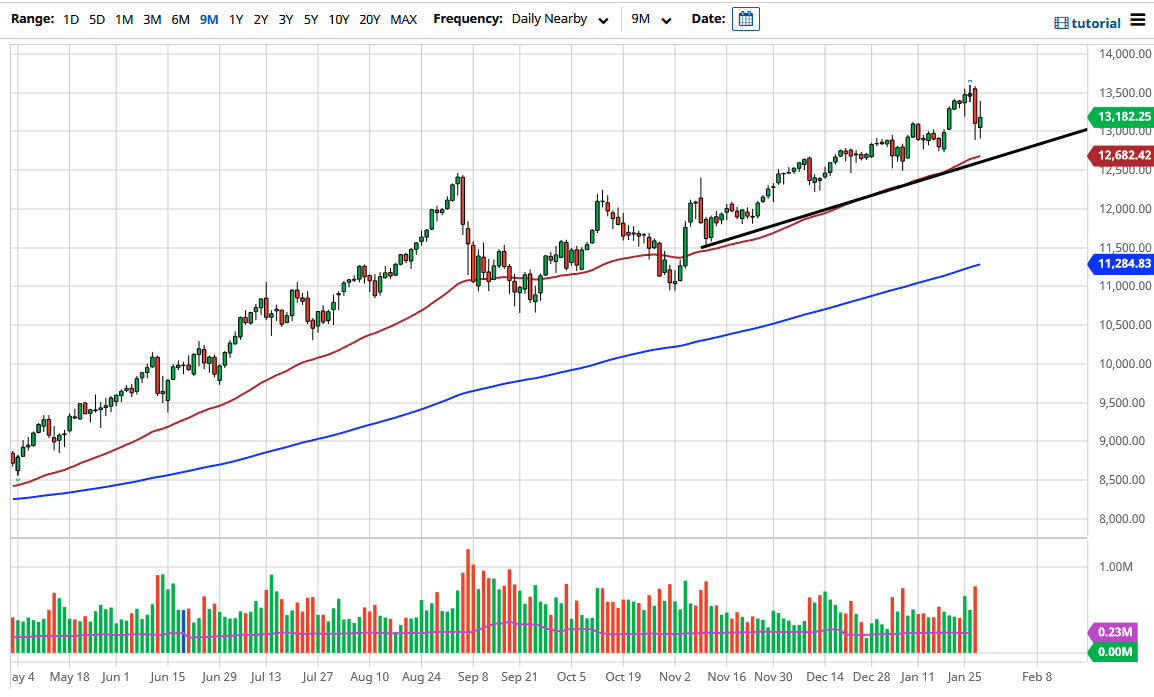

Looking at the chart though, I do think that the 50 day EMA is likely to see support for the market, just as the uptrend line is as well. That being said, I do think that this is a market that eventually will try to get to the highs. However, if we break down below here then we could go looking towards the 12,000 level. After that, then we could be looking at the 200 day EMA underneath.

All things being equal, this is a market that will find buyers given enough time, but I would not step in the way of a market that is falling drastically. In general, I do believe that this is a market that eventually will find plenty of traders looking to take advantage of what has been a freight train for the longer term. Ultimately, I have no interest in shorting this market but if I were to try to take advantage of the NASDAQ 100 falling, I would do so by using puts, not necessarily jumping in, and shorting right away because it only takes the slightest hint of the Federal Reserve stepping in and or the government passing some type of stimulus to turn this thing around and have this market skyrocket. Remember, the NASDAQ 100 is one of the favorite places for traders to throw money at, so once we do see the market turn around, it will certainly be very strong. However, we have some work to do before I would get overexposed and therefore I will build up my position slowly.