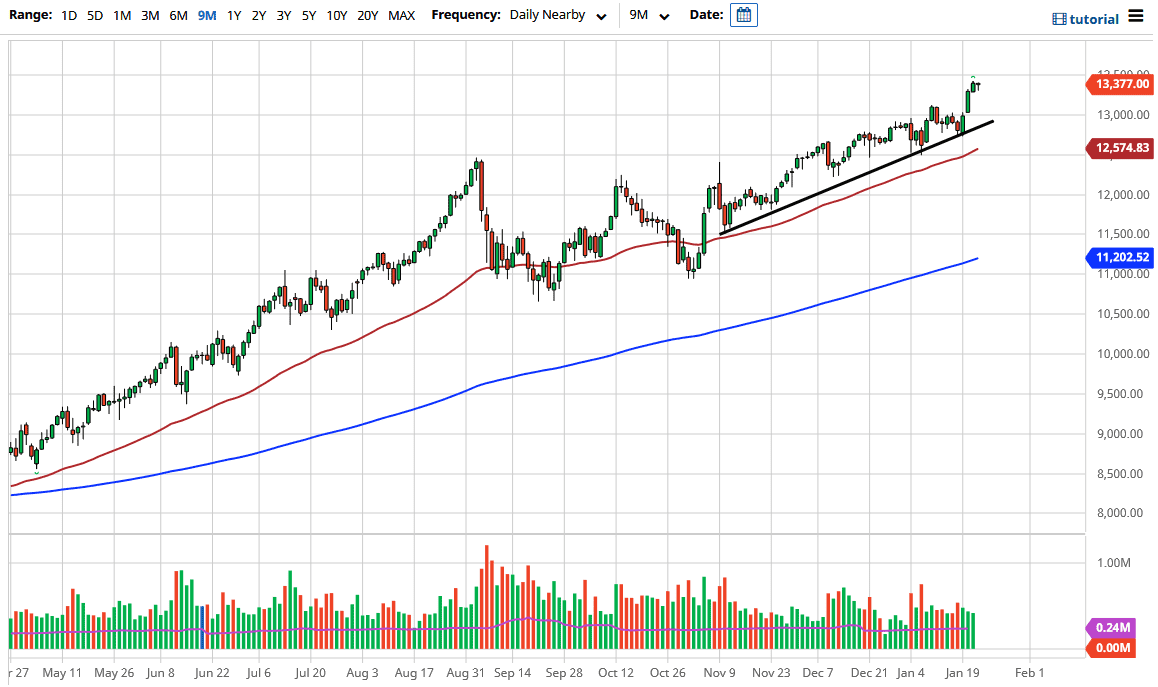

The NASDAQ 100 continues to show leadership when it comes to US indices, as the market initially sold off and then closed at the highs again. The fact that we have done this after such strength over the last three days suggests that we are going to continue to reach towards the 13,500 level rather soon. Keep in mind that the NASDAQ 100 is highly influenced by the “stay-at-home” trade more than anything at this point, due to the big technology companies that make up such a huge driver of this index, so most Wall Street traders will return to it by instinct if for no other reason.

To the downside, the 13,000 level should be very supportive, not only based upon the fact that it is a large, round, psychologically significant figure, but it is also roughly where the uptrend line crosses. As long as we see stimulus and the reflation trade and vote, this market will continue to see buyers. I think we are getting a little strained, but that should give us an opportunity to get long yet again.

To the upside, the 13,500 level offers a little bit of resistance. If we break higher and clear that level, then it opens up the possibility of a move towards the 14,000 handle. The 14,000 level is essentially the target based upon the previous consolidation, so it all ties in quite nicely. It also helps that people are starting to worry about the value of the US dollar, which has traders looking for assets to own. Unfortunately, this is all about just a handful of stocks, so you have to keep an eye on Microsoft, Facebook, Alphabet, and the like.

Even though we are just a bit stretched, the reality is that we are in such a strong uptrend that it is difficult to imagine a scenario in which things would change for the longer term. As long as the Federal Reserve is out there, it is likely that we will see any significant sell-off appeased by liquidity measures. The selling of this market would be very difficult, and it is simply easier to wait for value as it occurs. We are just a little overvalued, but that does not mean that we are about to change the trend.