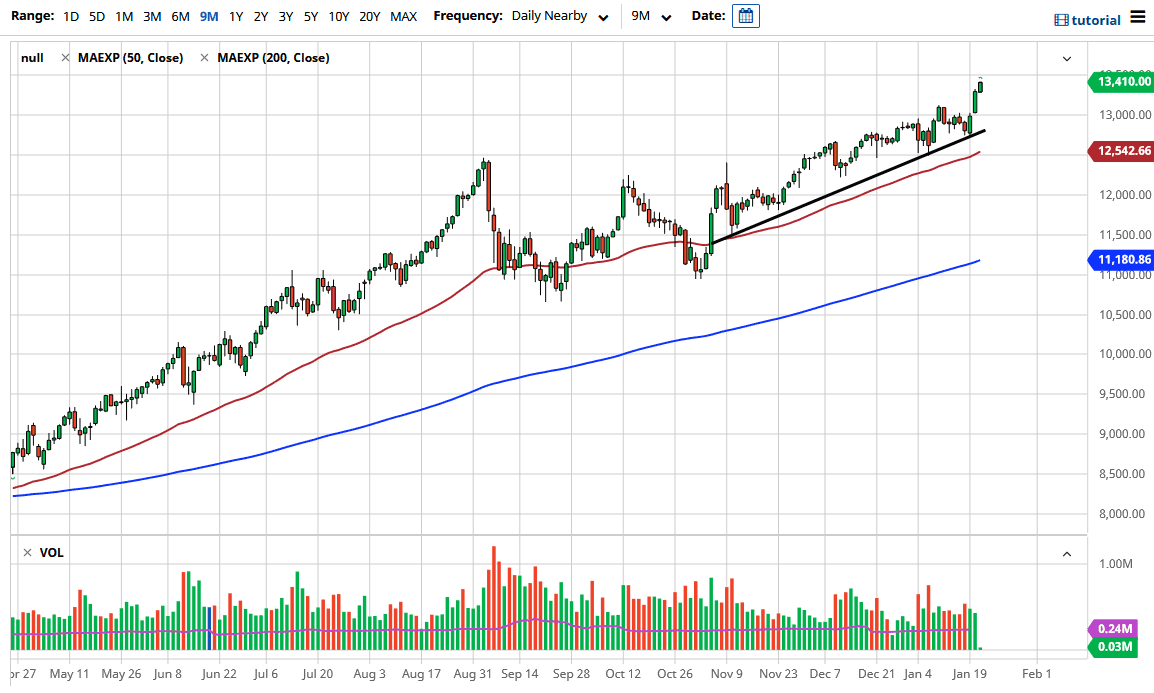

The NASDAQ 100 has rallied significantly during the trading session on Thursday again, as we continue to see a lot of bullish pressure in a market that is looking for the next handout. The “stay-at-home trade” is still starting to pick up a significant amount of momentum, as it looks like the “new normal” is going to have a lot of people working from home. The market pulling back at this point makes quite a bit of sense considering that we had gotten a little bit ahead of itself but given enough time it is very likely that we will see value hunters coming back into this market to take advantage of what is a massive amount of momentum.

To the downside, the 13,000 level could offer a significant amount of support, just as the uptrend line code. The 50 day EMA sits underneath there near the 12,541 level. At this point, the NASDAQ 100 is a market that continues to be very hot, and it suggests that the cheap money will continue to push this thing higher. However, we cannot go straight up in the air forever so ultimately this is a market that will have to pull back in order to build up enough momentum to go higher. The 14,000 level would be a target from the longer-term, but the short term I think the pullback should only be looked at as a potential opportunity.

One thing that could be causing a little bit of angst for traders is the fact that stimulus may not be as big as once thought, so it will be interesting to see whether or not we can continue to get overly bullish in the short term. I do think that eventually there is enough stimulus to make people happy, but in the short term it is very difficult to determine just how big it is going to be. As far as Wall Street is concerned - the bigger the better. Republican senators have been a little bit unenthusiastic when it comes to the idea of stimulus in the short term, and certainly this will continue to be a little bit of unease in the back of traders mind. However, if Wall Street is good at one thing, it is good at making up another narrative to buy stocks going forward.