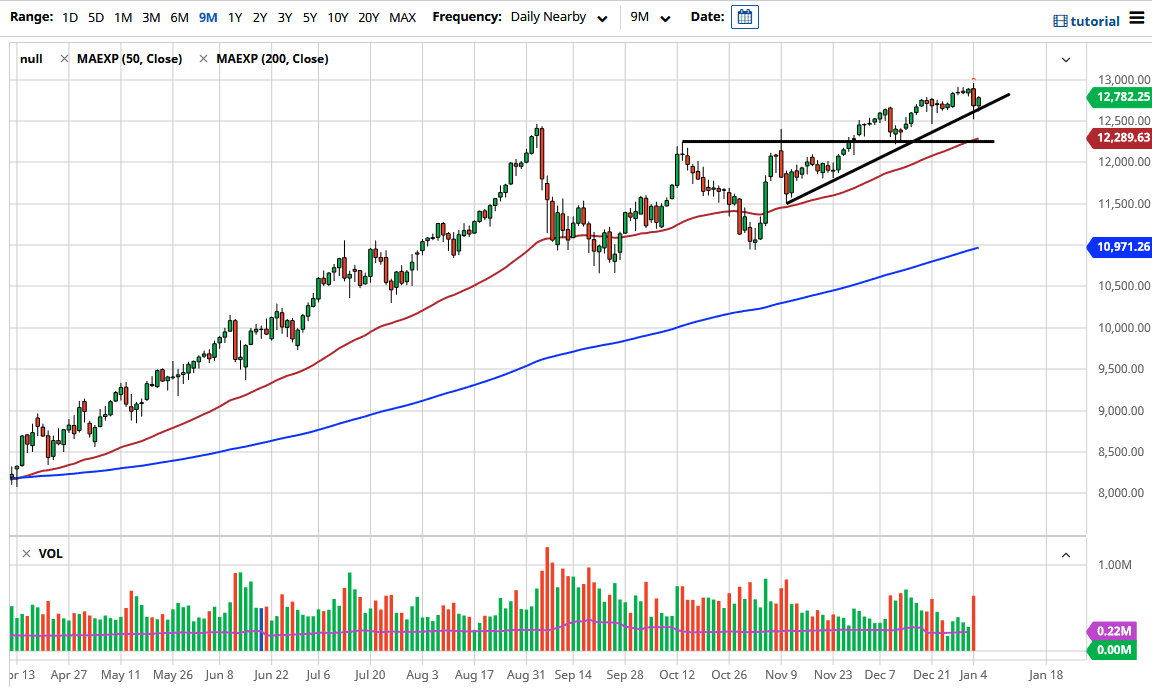

The NASDAQ 100 bounced a bit during the trading session on Tuesday as the uptrend line held. The market is likely to continue going higher, but we also have the Senate runoff election overnight, which could cause a lot of volatility. Short-term dips continue to be buying opportunities, with the 12,500 level being a nice one. If we can break above the 13,000 level, then it is likely that we will go much higher. Even if we were to break down below the 12,500 level, the 50-day EMA would also offer support near the 12,250 level. In other words, pullbacks should continue to be buying opportunities in what has been a very strong uptrend.

If we can clear the 13,000 level, then we can continue to go looking towards the 14,000 level, which is a target based upon the previous consolidation area, and the extrapolated move on the breakout. The NASDAQ 100 has been a leader in US and stock indices in general, so that could continue to be a reason to jump to the upside. I have no interest in shorting this market, because this is an index that you simply cannot sell, as all of the favored stocks on Wall Street continue to be the main drivers of what happens next.

I anticipate a lot of noise, so we should continue to see choppy behavior coming out of the markets in general, especially as we have to worry about coronavirus figures and the like. However, the NASDAQ 100 is a little bit insulated from that, as there is the “work-from-home trade” that is attached to this index in general. It continues to be a strange mix of value, growth, and perhaps even safety, which is a bit counterintuitive under normal circumstances. As long as there are signs of stimulus and the coronavirus causes issues, I believe that this index should continue to look very bullish of the longer-term. Regardless, I have no interest in trying to short it as it is still highly manipulated via the way it is weighted.