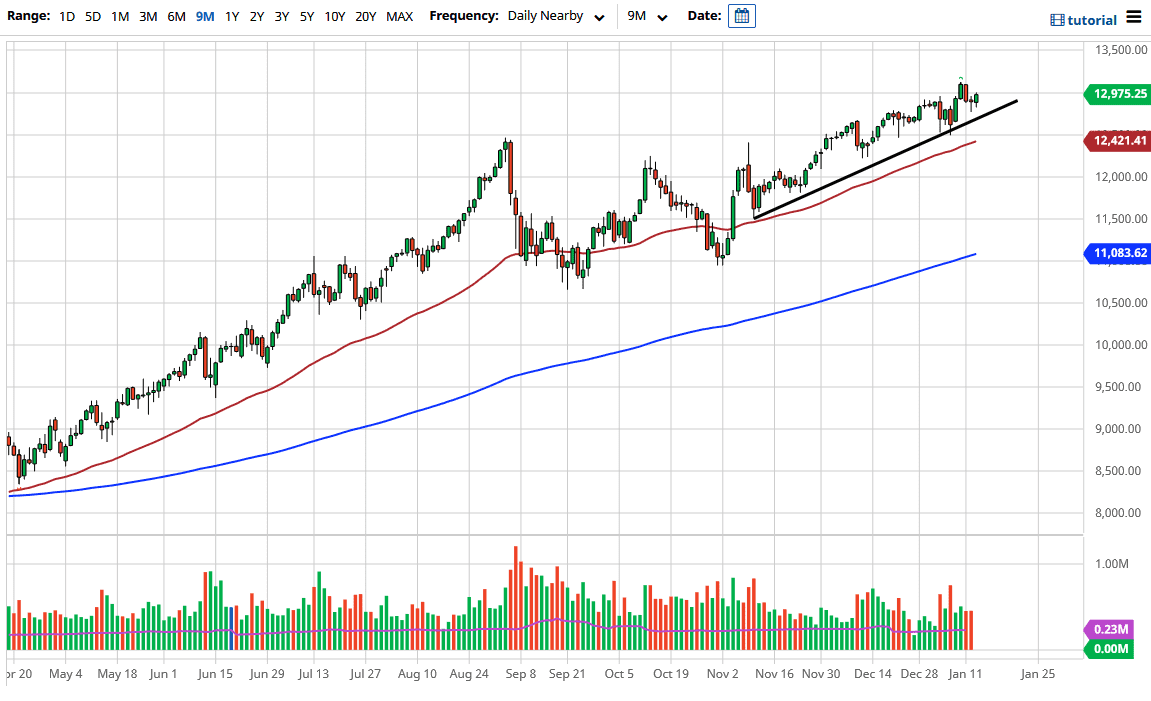

The NASDAQ 100 initially pulled back during the trading session on Wednesday only to turn around and show signs of strength yet again. The 13,000 level is most certainly being watched, and if we can break above there it is likely that the NASDAQ 100 should go looking towards the 18,125 level. This is a market that is ready to continue going to the upside, perhaps reaching to a fresh, new high again. The market is likely to see a lot of choppiness as we are in the midst of earnings season, but the uptrend line underneath continues to look very healthy and influential.

The trend has been rather straightforward and has shown itself to be very sustainable, meaning that the market is likely to continue to see more of a stable grind to the upside. As far as shorting is concerned, I do not have any interest in doing so, because not only do we have the uptrend line to pay attention to, but we also have to pay attention to the 12,500 level for support, and the 50-day EMA which sits just below there. The market will continue to see a lot of choppy behavior, but more importantly, it is likely to see continued buying, as we have seen time and time again.

To the upside, if we break above the highs, then we will go looking towards the 13,000 level, and then eventually the 14,000 level. I think we will go to the 14,000 level based upon the previous consolidation area and the extrapolated move and break from that sideways action that had been part of the market for a while. I have no interest in shorting this market, because given enough time, it is likely to find a reason to rally; if not for stimulus reasons, then perhaps because of a renewed selling of the US dollar. Regardless, it is not a market that you should be selling, because it seems to always find some type of narrative to push higher. In fact, if we do get a huge breakdown, I would simply look to buy at lower levels. This has been the way this market has moved for the last 13 years.