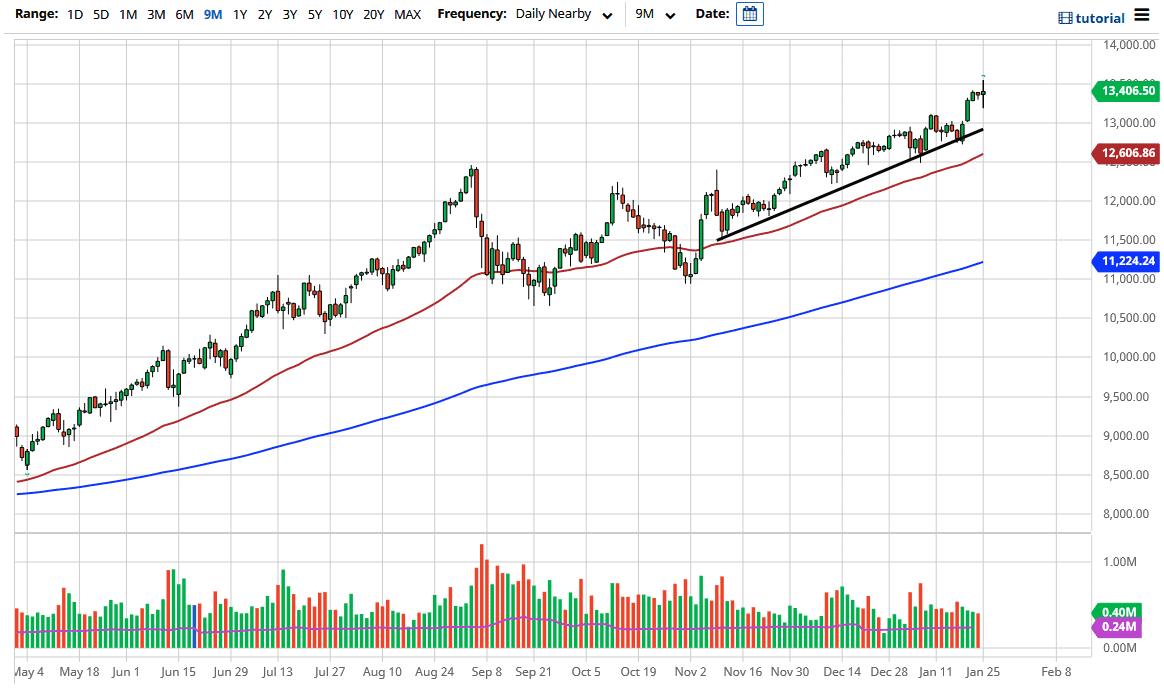

The NASDAQ 100 initially plummeted during the early hours of New York trading, but then turned around to show massive amounts of bullish pressure. We have almost completely recovered from the absolute highs, and even managed to gain 8/10 of a percent. This is a market that is beyond bubbly, and it now looks as if we are trying to break above the 13,500 level. You clearly cannot be a seller of the NASDAQ 100, especially as we have a lot of the major companies reporting earnings this week, and it is entirely possible that we could see a massive shot higher in some of the bigger ones. This market has no business being sold into, because you can see exactly how that has turned out.

To the downside, you can see that the 13,000 level is an area from which we had broken out, and we also have the uptrend line coming into play, as it has been so crucial. This is a market that continues to find plenty of buyers on dips, as it can only go up in this type of environment, and selling gets crushed. We are starting to see absolute insanity like Game Stop doubling during the trading session only to end up negative. At this point, the options market seems to be running the stock market, which is a great way to cause massive headaches and volatility. If that is going to be the case, the market will likely continue to be a “buy on the dips” type of scenario, as it has been forever.

The 50-day EMA currently sits at the 12,600 level, and that also supports the trend to the upside, so there are multiple reasons to believe that the buyers will be involved in this market on any type of dip. Therefore, I do not even have a scenario in which I am a seller. If I truly thought that the NASDAQ 100 was going to collapse, I would be buying puts, not shorting it, as that has crushed just about anybody who has tried to do that over the last decade or so. This market will look for some type of reason to go higher regardless of what happens.