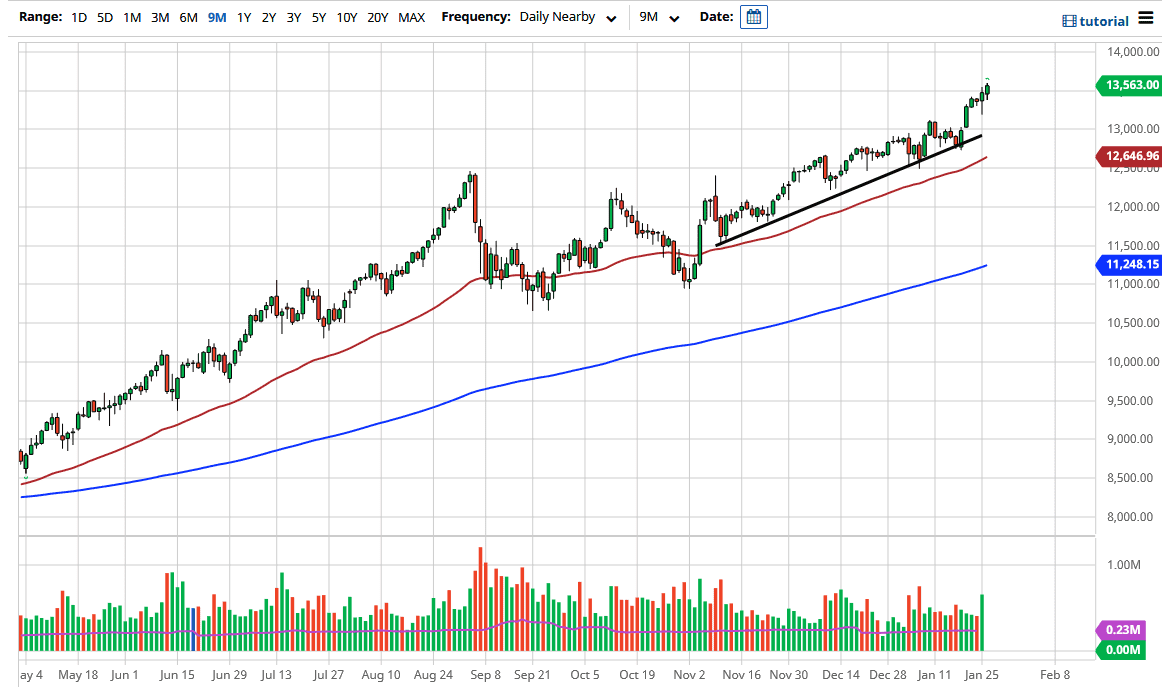

The NASDAQ 100 initially dipped during the trading session on Tuesday but then ended up plowing much higher as we continue to see a lot of upward pressure. Now that the market is above the 13,500 level, it is very likely that we will continue to take off to the upside. It is FOMC day, meaning that there will be an announcement and press conference with Chairman Powell. That will drive the risk sentiment, but it is very difficult to imagine a scenario where he does not kiss the ring of Wall Street.

I like the idea of buying dips, as they almost always provide buying opportunities in this type of environment. We are in the midst of a major melt up, and that is something that cannot be underestimated. With that in mind, I think that every time this market pulls back there will be plenty of buyers looking to get involved. FOMO has taken over and that is a dangerous thing to try to find. I think that the 13,000 level underneath should be the absolute “floor of the market”, as we have seen the market react to these large, round, psychologically significant figures, and show itself to be very interested in the 13,000 level previously. It is a simple matter of “market memory” coming back into play.

To the upside, I believe that the 14,000 level will eventually be the target and, given enough time, I do not see any reason whatsoever why we cannot get there. This is a market that will find one narrative or another to get to higher levels and volatility, the most obvious one being the “stay-at-home” trade. As long as there is more of a hybrid model of working in the United States, I believe that the NASDAQ 100 has a good shot at being strong. Add to that the fact that the Federal Reserve is going to flood the market with liquidity every time it gets an opportunity to do so, and that is going to continue to support stock markets in general, especially the handful that make up most of what we see in this index.