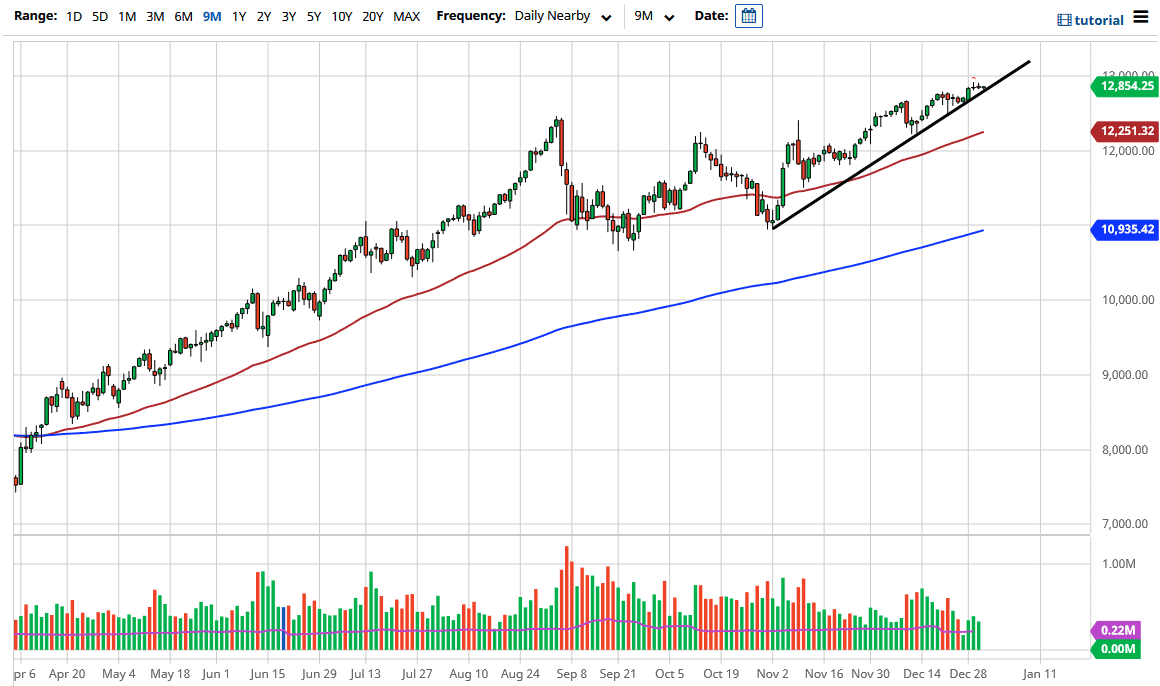

The NASDAQ 100 did very little during the trading session on Thursday, but that should not be a surprise considering it was New Year’s Eve and there was a lack of volume. The uptrend line on the chart has held so far and could come into play, but do not be overly surprised if we do break down below it. I do not think that that will be a major breakdown. It more than likely would end up being a scenario where we go looking for support underneath.

Looking at this chart, you can see that the 13,000 level was significant resistance three days in a row, but again, I would not read too much into it due to the time of year. I believe that we will eventually go looking above the level, but it may take a bit of a pullback in the meantime. The market sees plenty of opportunities to pick up value underneath, not the least of which would be the 12,500 level, and then the 50-day EMA which is closer to the 12,250 level. After that, we also have the 4000 level which is a large, round, psychologically significant figure.

To be honest, I do not see any opportunity to short this market, at least not until we break well below the 11,000 level, but as a general rule, I do not short this market. The 200-day EMA is sitting just below the 11,000 level, so I think this is where the “floor in the market” is sitting. This is a market that will continue to be in an uptrend due to the fact that the US dollar is getting sold off, which results in a lot of people buying stocks. Longer term, I believe that the NASDAQ 100 will go looking towards the 14,000 level. However, we have been in an uptrend for quite some time, so it is difficult to imagine a scenario in which we will not be. One of the biggest things that we could run into as a headwind might be a rotation out of a handful of stocks into a broader array of companies. That would simply be a short-term knock on this index.