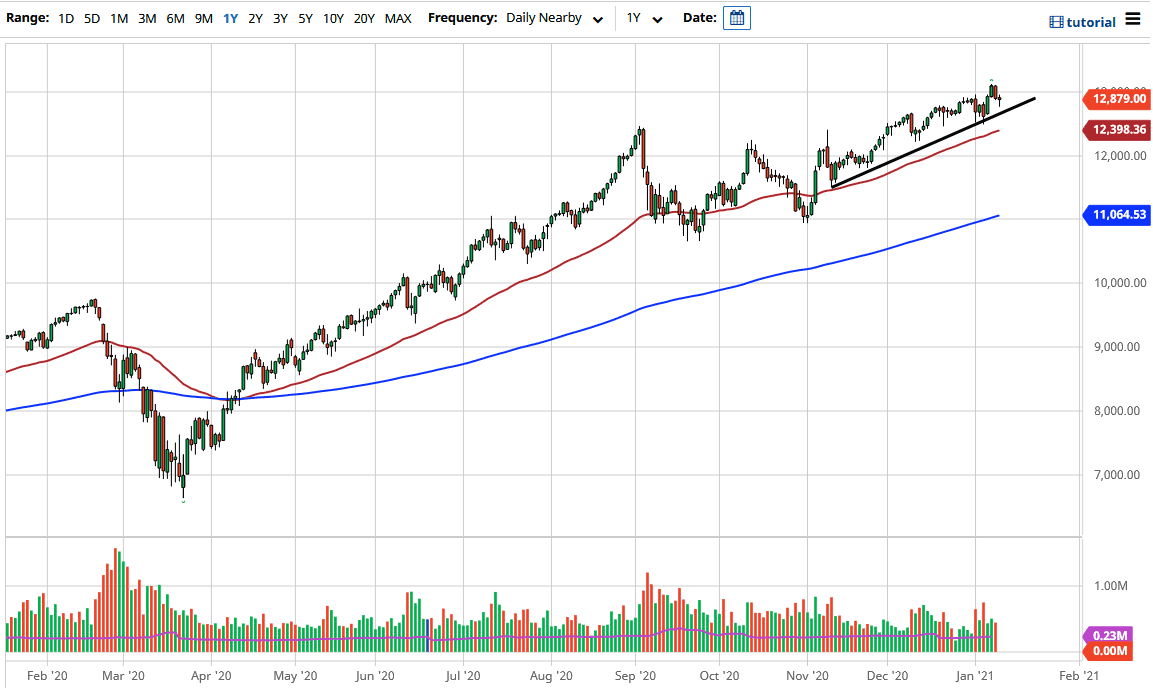

The NASDAQ 100 pulled back during the trading session on Tuesday to reach down towards the 12,750 level before turning around to show signs of life again. The typical reaction of the stock market has been to simply buy the dips, and there is nothing on this chart that tells me that we should be jumping out of the trade and trying to short it. I think that the long-term uptrend will continue, not only based on the uptrend line, but also the 50-day EMA underneath, down at the 12,400 level.

To the upside, I believe that this market is probably going to go looking towards the 14,000 level given enough time. We will continue to see a lot of back and forth, but ultimately, with the earnings season coming out now, it is likely that we will continue to see buyers on dips based on any signs of weakness, as the long-term trajectory demands it. I have no interest in shorting this market anytime soon, because every time you've tried to short the S&P 500 over the last 13 years, you have lost money with a couple of exceptions. It is simply not worth it, as the majority of the time you will benefit from picking up S&P 500 to the upside.

The stimulus should continue to flood the market with liquidity, and the NASDAQ 100 will continue to be one of the beneficiaries due to the fact that the massive tech stocks that have seen so much money thrown into them make up a huge part of the momentum. That momentum should continue to be a major factor, but it is likely that we will continue to see this uptrend line hold more than anything else, and once we get through this earnings season there is really no reason to short the market. I look at any breakdown at this point as a gift, and the 12,000 level is probably going to be your “floor in the market” going forward. It is going to take a while to get to the 14,000 level, but it is almost certainly the target at this point.