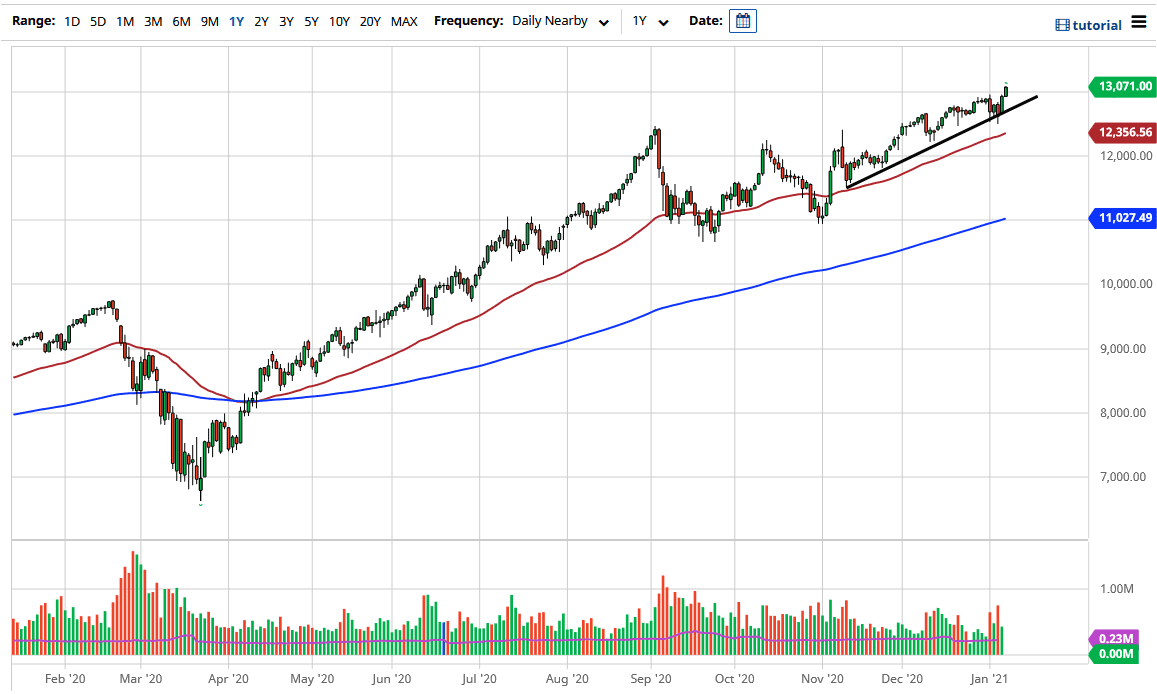

The NASDAQ 100 has broken above the 13,000 level, in a rather strong move late in the day. The beginning of the session had seen a lot of volatility due to the fact that the non-farm payroll announcement was at a loss of 140,000 jobs in the month of December. It looks like we will continue to see the technology stocks rally, and unlike the S&P 500, we had no significant pullback. This is a market that is ready to continue to go towards the 13,500 level over the next few weeks, and then possibly even as high as the 14,000 level.

The uptrend line underneath has been very supportive, and I think we will get an opportunity to take advantage of value on dips. There is no way you can short this market, because it is made up solely of technology stocks and is is not equally weighted. In other words, the handful of stocks that seem to be on the forefront of all trading is what drives this market to the upside, such as Microsoft, Netflix, Facebook, and so on. As long as that is the case, then it is difficult to imagine how people would jump in and start pushing this market lower.

Even if we were to break down below the uptrend line, it is likely that we could go looking towards the 50-day EMA, which is closer to the 12,350 level. At that point, you would be looking at a lot of value, and I cannot imagine a scenario where we would have people willing to sell this market anytime soon. If we do break down below there, then the 12,000 level is the next support level, which was the top of the previous consolidation area. Speaking of the consolidation area, it is very similar to what we see in the S&P 500, which in this case projects to the 14,000 level. This is why that is my target, and it looks like stimulus will continue to have money flowing into the stock market no matter what happens. Another thing that looks very healthy on this chart is the fact that the Friday candlestick closed at the absolute top of the range.