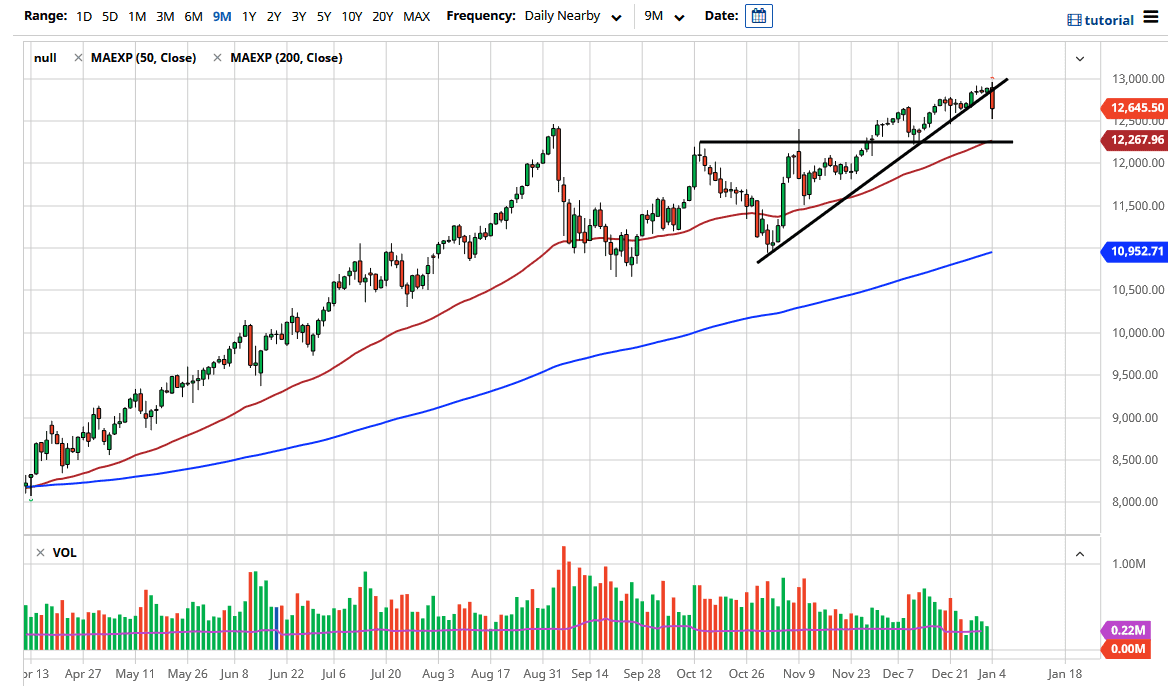

The NASDAQ 100 initially tried to rally during the trading session on Monday, but turned around to break through the uptrend line. By doing so, the market reached down towards the 12,500 level. This is an area that will attract a certain amount of attention due to the fact that the round figure is at play, and is an area from which we have seen a hammer bounce previously. Underneath there, the 12,250 level offers support as well. What is interesting about that area also is the fact that there is the 50-day EMA.

In other words, there are plenty of areas underneath that could cause a bit of value hunting. This is provided we get the Senate election out of the way; I think it is only a matter of time before the buyers will get involved. This is all about risk appetite, but it should be noted that later in the day we started to see buyers jump in, which is a sign that there is some underlying demand. Long term, I would expect plenty of value hunting going forward, and I have no scenario in which I'm willing to sell this market due to the fact that the NASDAQ 100 features all of the favored stocks of Wall Street, There is no reason to think that the market suddenly will “find religion” and start paying attention to things like valuations. We are in an uptrend, and there is no reason to overthink it because that has not paid off in most of the last 13 years.

The market should eventually go looking towards the 14,000 level based upon previous action, and also based on a measure of the consolidation area between roughly 11,000 and 12,500 from which we broke out. In fact, you could look at the session on Monday as a simple retest of that previous area. Because of this, the measured move is what I am using for a target, but I recognize that it is going to be difficult to hang on for the entire move in one trade. However, if you are an investor, that would be the play. I continue to look for dips to buy in this market, and this candlestick will offer yet another buying opportunity.