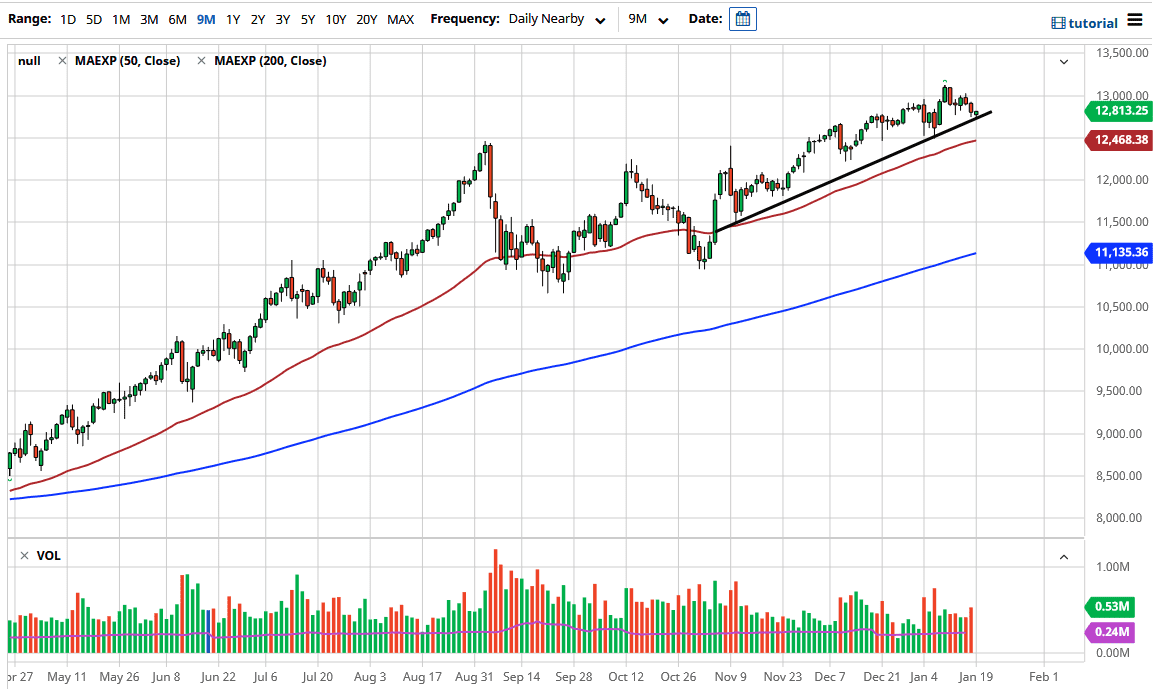

The NASDAQ 100 did very little during the trading session on Monday, as it was Martin Luther King, Jr. Day in the United States. Obviously, the underlying index itself was not moving, but the futures market was. Electronic trading tends to be overlooked by a lot of Wall Street traders, so I do not think that many people will be paying close attention to the candlestick for the day. You can see that I have a trendline sitting just below that the market still seems to be trying to hang onto, so pay attention to that. Given enough time, the market is likely to see buyers jumping in to take advantage of the longer-term uptrend, but we are obviously in the midst of earnings season, which can cause significant volatility.

At the end of the day, though, Wall Street does not care about earnings, they care about liquidity. Liquidity will be supported going forward, perhaps forever by the Federal Reserve, so I think it is only a matter of time before any pullback gets bought into. The market is likely to be one that you can buy on dips, and the 50-day EMA underneath could be a nice buying opportunity closer to the 12,500 level.

To the upside, I recognize that the 13,000 level is an area that will be slightly resistive, but we have broken above it previously so I do not think that breaking above it the second time will be overly difficult. Eventually, the market will go looking towards the 14,000 level over the longer term, due to the fact that the market will be driven higher in order to take advantage of that liquidity forced down the throats of financial markets. The market previously had been consolidating underneath, and the extrapolated breakout move was for the 14,000 level. If we can break above there, then I think the next target will be 15,000, as it is a large, round, psychologically significant figure. I have no interest in trying to short this market, as I see multiple areas underneath that could also offer support, not the least of which was the previously mentioned 50-day EMA. The 12,000 level underneath there would be psychologically important as well.