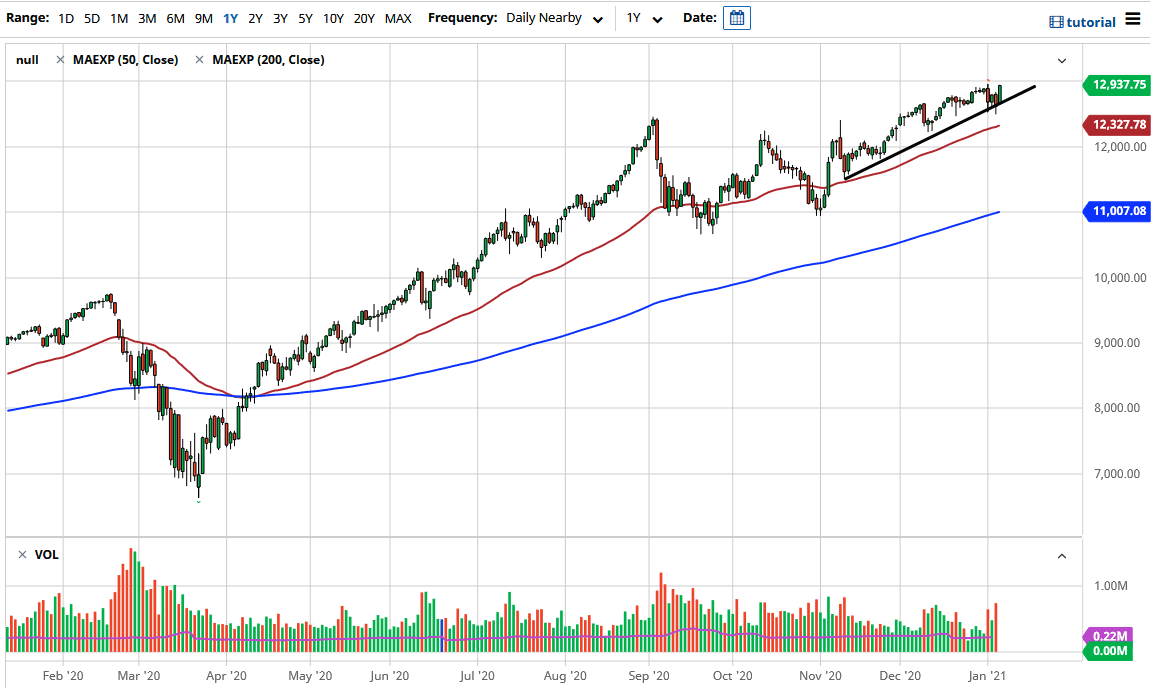

The NASDAQ 100 has had a good session on Thursday, as we continue to see bullish pressure. The uptrend line underneath continues offer support, and it looks like we are going to go looking towards the 13,000 level. If we can break above the 13,000 level, then the market is likely to go looking towards the 14,000 level. At this point in time, when you look at the previous consolidation area, it goes from the 11,000 level to the 12,500 level. That is a 1500 point range, and I think that if you extrapolate this out, you should be looking at a move to the 14,000 level which is my longer-term target.

The size of the candlestick is rather strong, showing signs of real momentum to the upside. The fact that we close that the very top of the range typically means that you are going to see a bit of follow-through. With the Non-Farm Payroll number coming out on Friday, that could cause a bit of volatility but at this point in time, perhaps offering a little bit of a dip that we can start buying into. That being said, the market is likely to continue seeing a “value hunting” type of investor come out on top. Even if we break down below the uptrend line, it is very likely that the market then goes looking towards the 50 day EMA underneath. The 50 day EMA does tend to be followed quite a bit by technical traders, and of course we have the 12,000 level underneath that.

I have no interest in shorting this market, because every time you have trying to short the NASDAQ 100, you have gotten hammered. I do not see that being any different now that we are looking at more stimulus coming out the United States, which is the only thing that the markets care about for a longer-term move in this market. People will continue to buy the dips, and now there is even a narrative on Wall Street that if the millennials get $2000 stimulus checks, bills go directly back into the stock market. Why not? It seems to be what happened last time there was a bunch of money handed out. Regardless of the reasoning, there is no way to short this market as it is far too bullish.