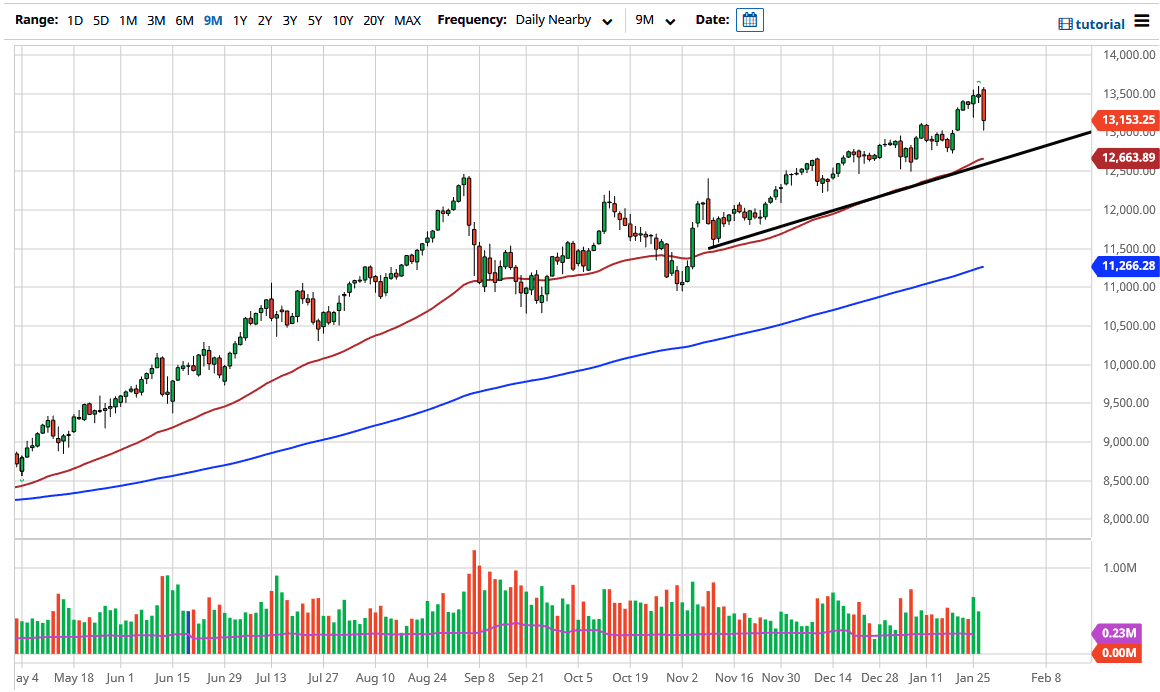

The NASDAQ 100 has broken down significantly during the trading session on Wednesday to show a massive turnaround in attitude. That being said, a lot of this is probably due to a short squeeze being thrown at hedge funds that are now having to cover all kinds of financial destruction done by Game Stop. Nonetheless, we are still very much in an uptrend and even though there has been a lot of technical damage done, we are nowhere near shifting the overall attitude of the market. I think that we may have a little bit of continuation due to the fact that we are closing towards the bottom of the candlestick, but over the longer term will continue to see plenty of support.

What I am looking at here is the 13,000 level which of course has its own support due to the fact that it is a large, round, psychologically significant figure, but I am also paying attention to the fact that the 50 day EMA sits just underneath, and I think that will have a certain amount of significance in play as well, as the uptrend line sits just below it also. We are in a massive uptrend and I think that is it going to change anytime soon. The 13,500 level will be obvious resistance as it has been such a massive selloff point, so I think that is going to be your short-term ceiling given enough time. As far as breaking down below the trendline is concerned, it is possible it happens, but I think that then we would be looking towards the 12,000 level, possibly even the 200 day EMA underneath that.

All things being equal, I do think that if you give the market enough time it should offer a buying opportunity. While the NASDAQ 100 was down almost 4%, it is not necessarily a sign that we are suddenly going to melt down. I do think that the market is getting way ahead of itself and some type of pullback needs to happen, but right now I think that we have little bit of flight left in the market as far as the short term is concerned. I do not short indices, but if I believe they are going to fall apart I would be buying puts at this point more than anything else.