Silver markets gapped higher to kick off the trading session on Thursday, but then turned around to pull back and fill the gap. Market participants continue to pay attention to the Federal Reserve and other central banks around the world as stimulus and monetary policy continue to look very supportive for precious metals and an escape to hard commodities instead of sitting in fiat currencies.

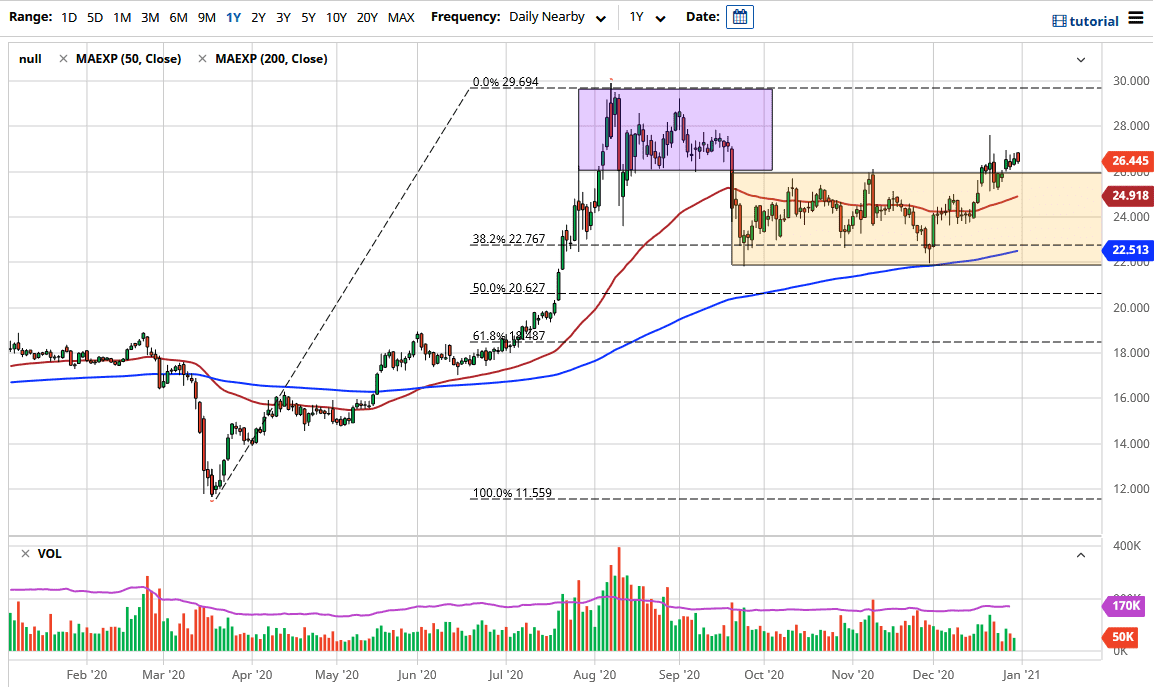

The $28 level above is significant resistance, and I think that it is only a matter of time before we tried to challenge to that level. The $28 level opens up the possibility of a move to the $30 level, so it is only a matter of time before we go to the upside and grind away. That suggests that we will probably have a lot of choppy behavior ahead of us, as the markets have a lot of work to do. Underneath, the 50-day EMA offers support as it is sitting just below the $25 level and is also tilting higher. There is a lot of noise in this market, and silver does tend to be very volatile, to say the least.

This market will have a good year, especially as central banks and governments continue to flood the markets with currency. Stimulus, monetary policy, and a whole list of expanded spending should continue to favor precious metals in general going higher. Silver is highly sensitive to the reflation trade, as well as the fact that the industrial demand for silver, in theory, will be stronger.

As you can see, the market had pulled back towards the 200-day EMA, and then bounced significantly. Beyond that, the 38.2% Fibonacci retracement level has held up for support, and its suggest that we will go much higher, due to the fact that when we see the market pullback this little, that typically means that there is a lot of momentum and underlying demand. This market will continue to move inversely to the US Dollar Index as well. Keep an eye on all of the things going together, and place your trades in silver accordingly. Buying short-term dips should continue to be a buying opportunity as the longer-term outlook for silver is great.