Silver markets did very little during the trading session on Tuesday as traders around the world await the results of the FOMC meeting, and perhaps more importantly, the press conference afterwards. This could give us a bit of a “heads up” as to what we are going to see coming out of the Federal Reserve as far as monetary policy is concerned. Nonetheless, silver has been hugging the 50-day EMA, and that most certainly is something that will attract a certain amount of trading volume.

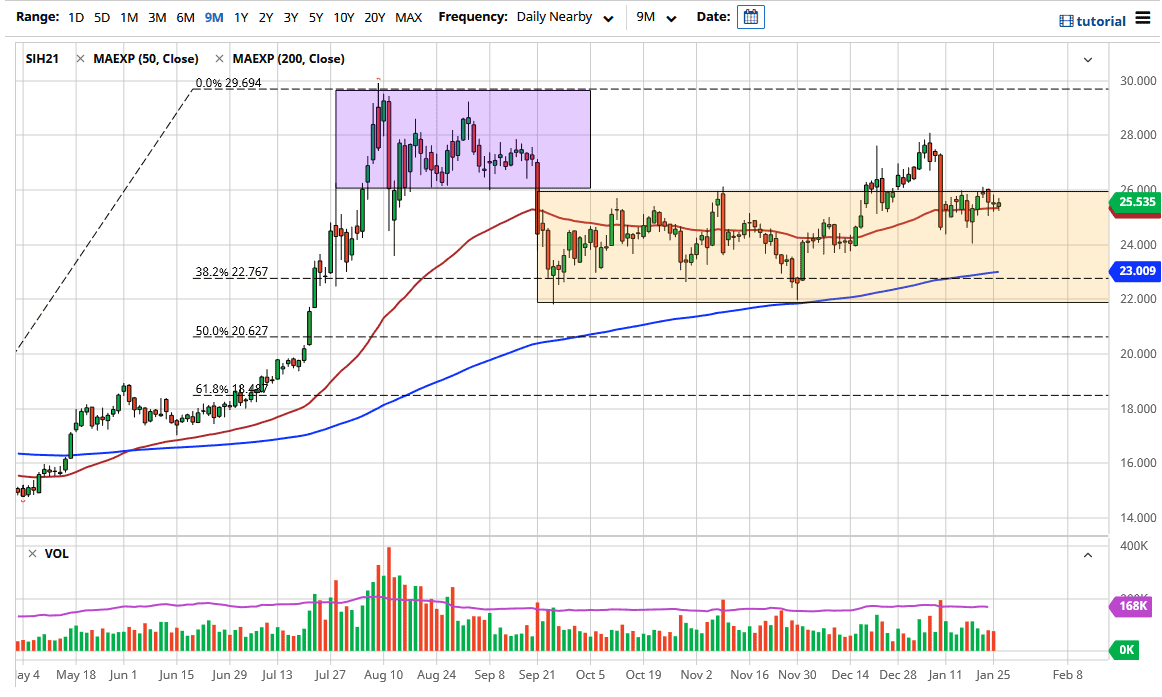

To the upside, the $26 level should continue to be resistance, and if we can break above there, most likely after the press conference Wednesday, then silver is likely to go looking towards the $27.50 level above. A break above that level could open up the possibility of a move towards the $28 level which recently had been a short-term peak. On the other hand, if Jerome Powell does something to upset the apple cart, we could see the US dollar strengthened and that more than likely would send silver looking towards the $24 level underneath. Between now and then, if I were forced to take a trade, I would assume that it should favor precious metals to the upside, but there is also the possibility that he does not do enough to make Wall Street happy, and then who knows what happens next?

The 50-day EMA is a technical indicator that a lot of people follow, so that in and of itself is probably worth paying attention to, as it has been relatively reliable in the past. I do believe that eventually we will break much higher, but the question for me at this point is whether or not we need to pull back between now and then. If we did, then I anticipate that the $23 level, which currently features the 200-day EMA, could be a potential buying opportunity if we did break below $24. Regardless, I do not have a scenario in which I would sell silver right now; it has far too much cyclical value in what should in theory be an inflationary timeframe over the next year or two. Furthermore, you can make an argument for more industrial demand coming down the road if stimulus does in fact become the main focus of the Biden administration, which certainly looks to be the case.