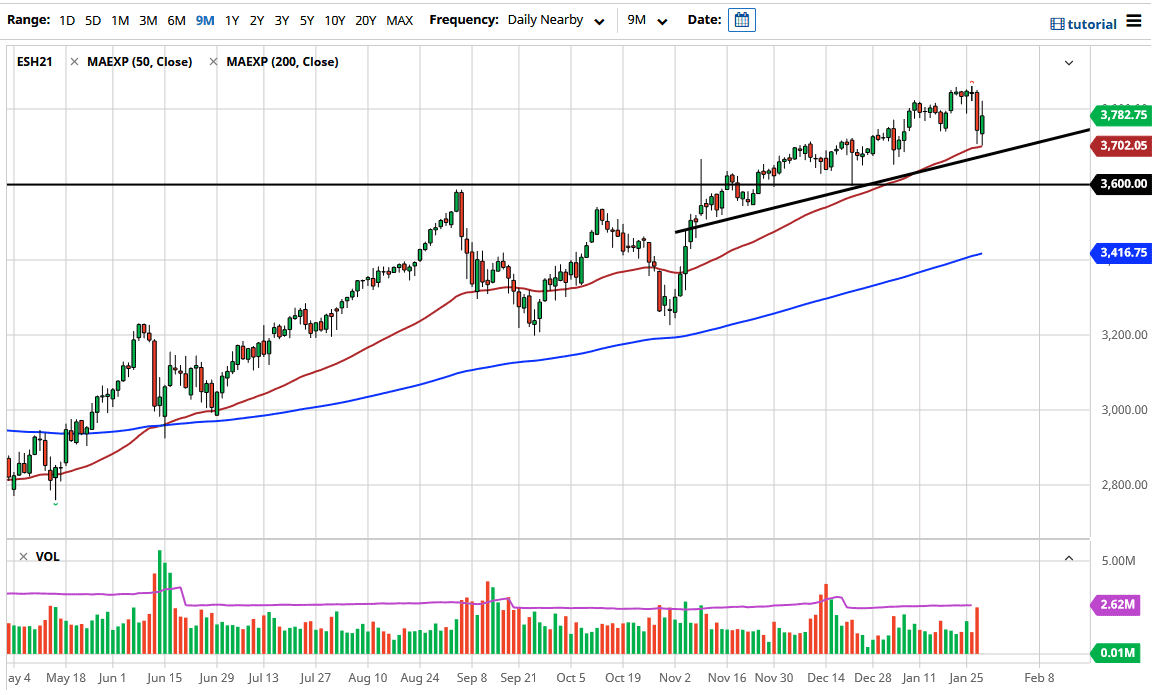

The S&P 500 initially fell to kick off the trading session on Thursday but turned around to show signs of life at the 50 day EMA yet again. Furthermore, the 50 day EMA sits just above a massive uptrend line, so it is not a huge surprise to see that we rallied a bit. We even pierced above the 3800 level, so now that we have pulled back from there, I think this shows that we could see a lot of back and forth momentum as we try to build up a move to the upside. All things being equal, I do think that we eventually will go to the upside, but I think it is going to be very noisy in the meantime.

Adding more chaos to the pictures the fact that we are in the midst of earnings season and of course it is likely that we will see the occasional hiccup in both directions due to that. However, we are in a massive uptrend and therefore I think it is only a matter of time before buyers would come in on the dips. Even if we break down below the uptrend line, I think that we could go looking towards the 3600 level which of course is a level that has been important previously. Even if we did break down below there, it is likely that we could go down to the 200 day EMA which is closer to the 3400 level.

If we do break down below the 3600 level, then I would be looking at the possibility of buying puts, because I have no interest whatsoever in trying to short a market that is so highly manipulated by the liquidity that is being thrown into it. I think at this point, the market is likely to see choppiness, but I still believe that eventually traders will try to lift this market as they do over the longer term. I think shorting is always going to be difficult, because the index is not built to do that. The index is not equally weighted, and that is one of the most important things to keep in mind. It only takes a handful of companies to rally in order to push higher and higher. In fact, some people are starting to refer to the S&P 500 as the “S&P seven.”