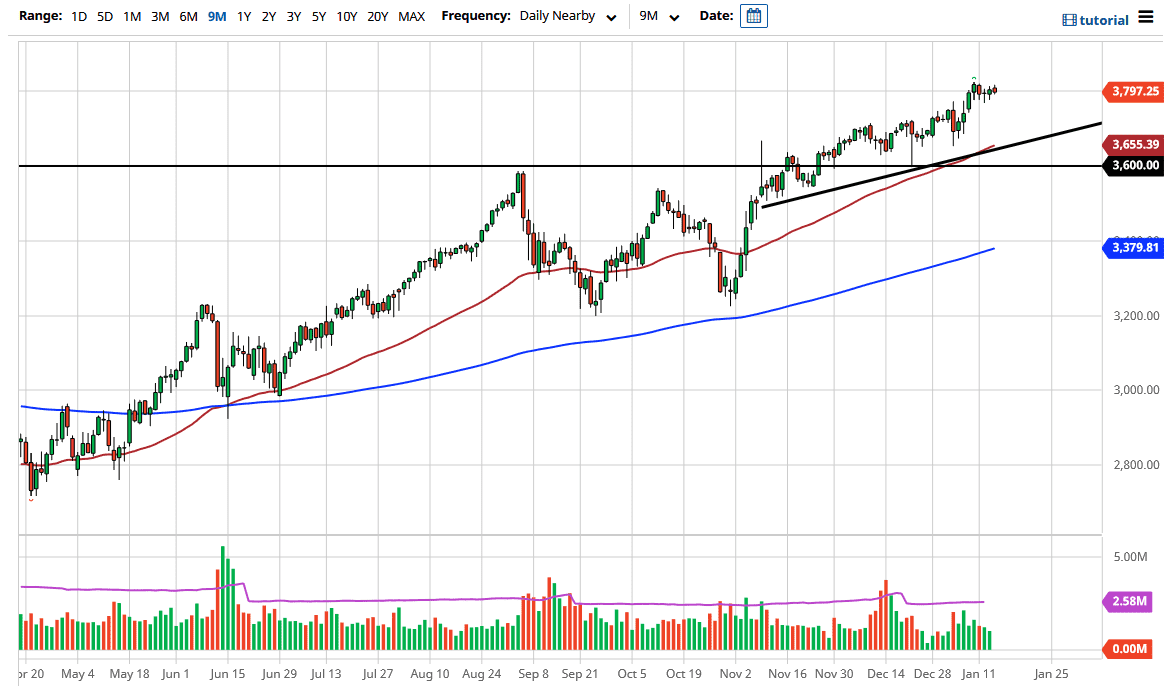

The S&P 500 has initially tried to rally during the trading session on Thursday but then turned around to show signs of weakness. At this point, we are hanging around the 3800 level and it looks like we are simply killing time as we head into major earnings. As we get bank earnings, that should continue to put more directionality in this market, but the only thing the market cares about over the longer term is going to be liquidity. As long as they keep flushing the markets full of liquidity, they will eventually go higher.

The 50 day EMA is currently hanging on the uptrend line underneath, which is all the way down at the 3655 handle. I do not think that we get there anytime soon, but that is essentially what I am looking at as a potential “floor the market.” The idea that the market breaks down through there would be a bit of a stretch at this point, but even if it did, I think that the 3600 level then becomes massive support.

To the upside I think it is probably a 4000 target we are looking at, based upon the previous consolidation area. The area between 3230 600 had been very important previously, and now that we have broken out of it one would think that we should continue to go higher and towards the 4000 level based upon the projected extrapolation of that move. I do think that given enough time we will get there, but it may take quite some time to get there. This is more or less a longer-term target, something that could be reached as late as summertime. In the short term, I think that pullbacks continue to offer value the people are more than willing to take advantage of, and we have seen a little bit of that during the past several days, but on a microscale. I still think there are plenty of people willing to jump in at the first signs of a significant pullback, because so many people are expecting an explosive growth pattern from various countries around the world for the year as the vaccine gets rolled out. Ultimately, looking for dips is probably the best way to trade this market going forward as selling has been nothing but pain for most people and of course stimulus will only propel the already bullish attitude on Wall Street.