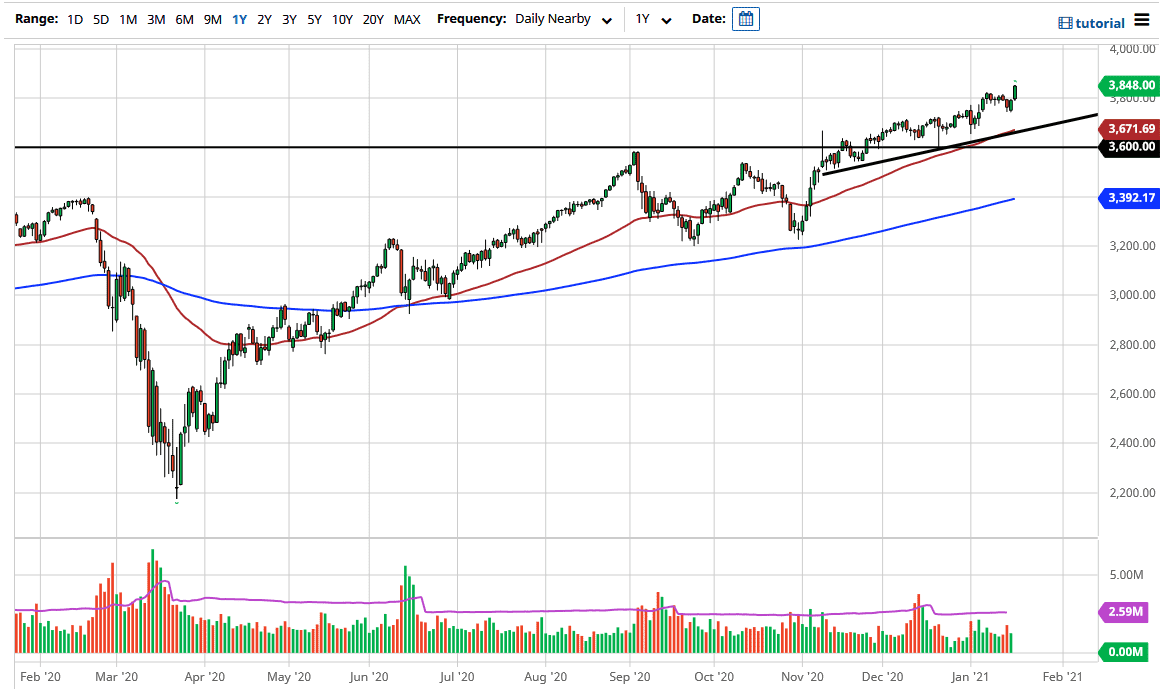

The S&P 500 has rocketed higher during the trading session on Wednesday, breaking towards the 3850 level and closing towards the top of the candlestick, which is without a doubt the strongest signs you can see. Ultimately, this is a market that I think continues to go much higher but will have the occasional pullback. At this point, it appears that Wall Street is focusing on Janet Yellen basically promising to do everything she can to support them. This is the game that we have been playing for 13 years now, Wall Street gets what it once in the form of liquidity.

Adding to that is the fact that the earnings season has actually been pretty good, buyers are out in full force. We are getting towards the top of what could be conceptualized as an up trending channel, so we might get a short-term pullback. Even if we do, then I would be a buyer, especially if we pulled back towards the 3800 level. Currently, I do believe that the market is going to go looking towards the 4000 handle, so I do like the idea of buying dips and I certainly have no interest in shorting this market.

As we continue to see the markets show signs of strength, I think what we will get here is a simple continuation of what we have seen over the last several years, every time there are sellers and concern out there, there will be a narrative the hits the wires the analysts or Federal Reserve officials that give traders a reason to get long yet again. The 50 day EMA underneath should continue to offer support, just as the uptrend line well. That being said, you can also add the 3800 level as support of between here and there as well. In other words, the best trade is to simply look for value and take advantage of it at one of these levels. I have no interest in trying to short this market, because quite frankly anytime you short the index you are fighting the Federal Reserve and everybody else in the world. Yes, there are times where you can make a killing shorting the markets, but those are so few and far between that there is no point in even attempting it.