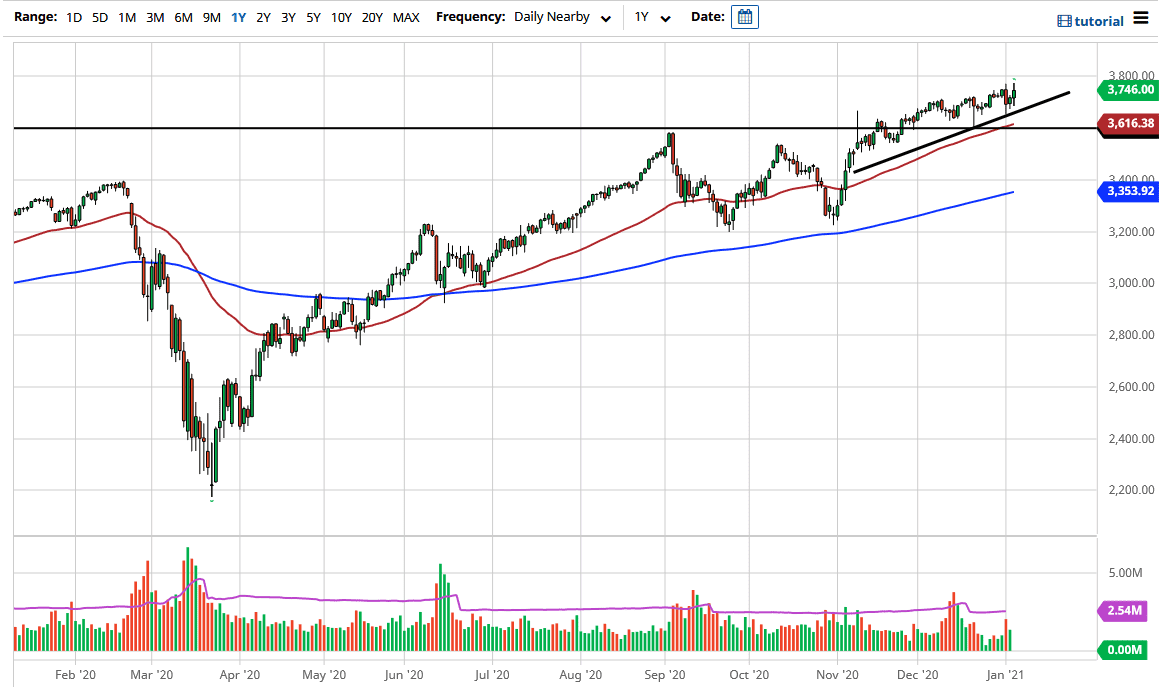

The S&P 500 fluctuated during a wild trading session on Wednesday. The session initially started rather negatively, as the Globex session had seen a lot of concern as the Democrats take over the Senate. People are worried about the possibility of taxation changes and regulatory issues. However, later in the day, people started to focus on the idea of more stimulus, which has been the main driver of stocks over the last 13 years. The uptrend line sitting underneath there is also supportive, and it is only a matter of time before buyers jump back in. After all, there is one thing Wall Street is good at: coming up with a narrative that makes stocks go higher over time.

The 50-day EMA sits underneath that uptrend line, raking above the 3600 level. There are plenty of reasons in that area from a technical analysis standpoint to think that we will continue to go higher. Furthermore, we have just broken out above the major consolidation area that measured from the 3200 level on the bottom and the 3600 level on the top. That is a 400-point range that extrapolates for a move towards the 4000 handle. That is my longer-term target, and we will see a gradual grind towards that region.

I have no interest in shorting this market, especially if the US dollar continues to face pressure. Buying dips continues to be the best way going forward, but we may have a couple of rough days ahead of us. On top of everything else going on, including protesters flooding into Capitol Hill, we also have the jobs number at the end of the year which is going to cause a certain amount of trouble. This is a market that will simply continue to grind from what I see, so short-term traders will continue to pick up dips, while long-term traders will simply continue to hang on to the overall trend which has been so firmly ensconced in this market for years. The one thing we have learned over the last decade is that with the distortion of markets by the Federal Reserve, it is almost impossible to short.