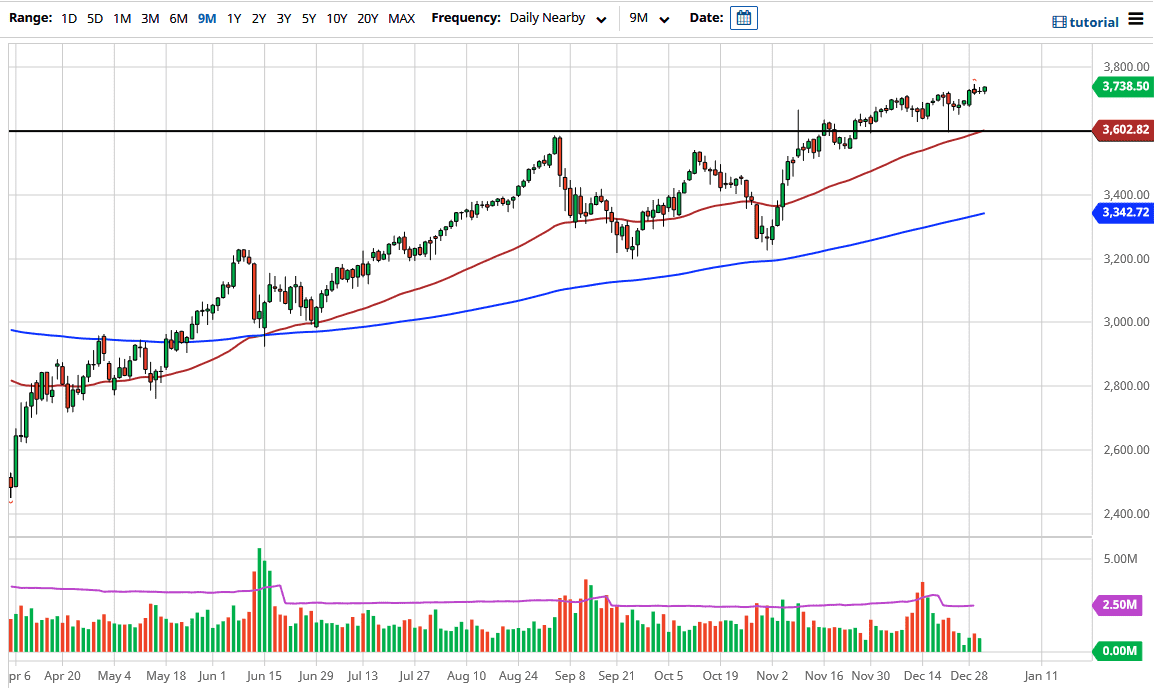

The S&P 500 rallied a bit during the trading session on Thursday, as we continue to see plenty of buying pressure overall. This is a market that continues to go looking towards the 3800 level. Short-term pullbacks should be buying opportunities, and the 3600 level underneath is a massive floor in the market just waiting to happen. Not only is it a large, round, psychologically significant figure, but it is also an area in which we had seen previous resistance. In fact, when you look at the consolidation underneath, we have been bouncing around between the 3200 level and the 3600 level for quite some time. This would be a simple retest of this area, but we have already seen that attempted.

The 50-day EMA sits at the 3600 level as well, which makes it even more supportive. The extrapolated move from the consolidation area previously suggests that the S&P 500 will go to the 4000 handle, and I think that given enough time we will get there. I do not expect that to happen in the short term, though; it is more of a longer-term prospect.

The US dollar continues to get sold off, which helps stocks, and we do know that the Federal Reserve is out there willing to protect Wall Street any time we get a significant selloff. Dips continue to offer buying opportunities, and in time, we will see plenty of people looking to pick up these dips, because a lot of people may have missed out on the move. There will be a certain amount of rebalancing at the beginning of the year, so I would not read too much into choppiness, as portfolio managers will be looking to put money to work for the new year. It is obvious that the trend is higher, so I do not have any interest in trying to get too cute with a market that is very strong. Buying dips continues to work as it has throughout the year, and unless something drastically changes from a macroeconomics point of view, I do not see that changing anytime soon.