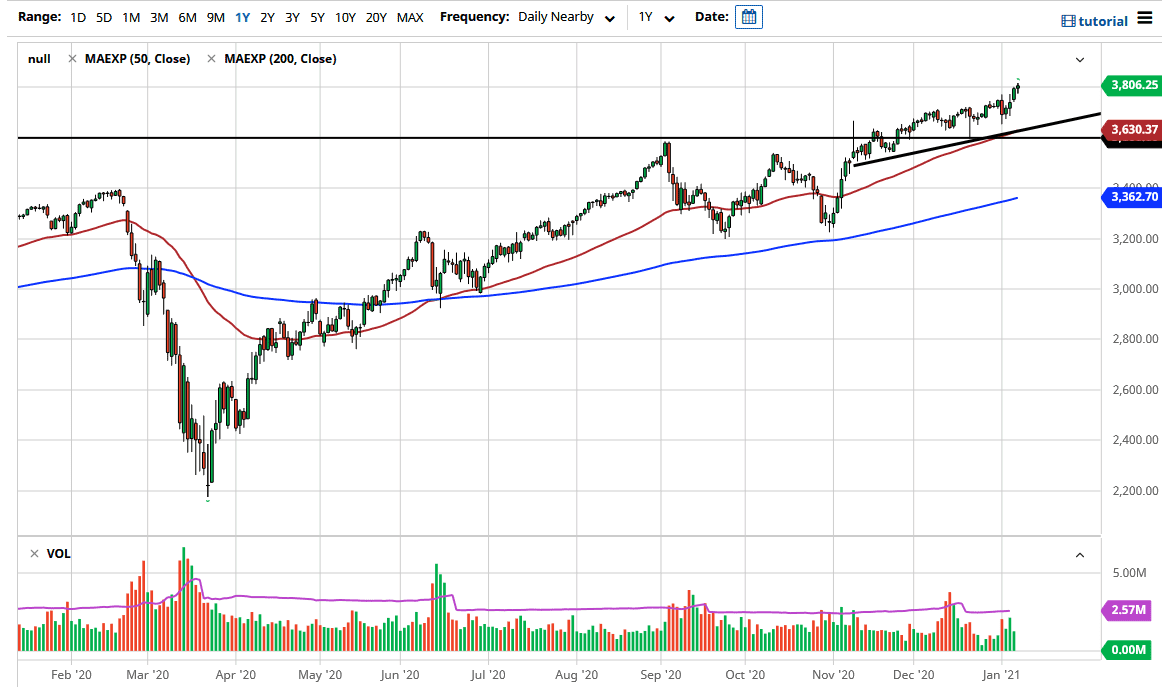

The S&P 500 was choppy during the trading session on Friday as we bounced around due to the non-farm payroll announcement. The overall attitude of the market has been bullish for some time, and it looks likely that the 3800 level is going to continue to be an area of interest. If the market was to pull back from here, then there should be plenty of support. The 3750 level should offer support on short-term charts, and so should the 3700 level. I think this is a market that, given enough time, should continue to see a lot of noisy buyers underneath.

The uptrend line underneath should continue to offer a certain amount of support, as it has been reliable for some time. The 50-day EMA has crossed above the 3600 level, and now looks to support that uptrend line as well. When you look at the overall attitude of the market, it has been very strong. Furthermore, when you look at the previous consolidation area between the 3200 level on the bottom and the 3600 level on the top, it is a 400-point range. You can extrapolate the move from the 3600 level to reach towards the 4000 level, which is my long-term target. That does not mean that we will get there overnight, but I think short-term pullbacks will continue to be thought of as value and, certainly with the idea of stimulus out there, they will be attractive for most traders.

Remember, the last 13 years have been all about stimulus and cheap money when it comes to stock markets rising. That continues to be the overall attitude of markets: rising on stimulus. With the poor jobs number that we got earlier in the day, that means that there will be more stimulus, and people will be looking to buy stocks because that is like rocket fuel for Wall Street. I believe at this point it is likely that we will continue to see traders base their positions off this, and we will continue to see this market go higher. I have no interest in shorting, at least not until we break down below the 3600 level, and even then, I would be very hard-pressed to be a short seller.