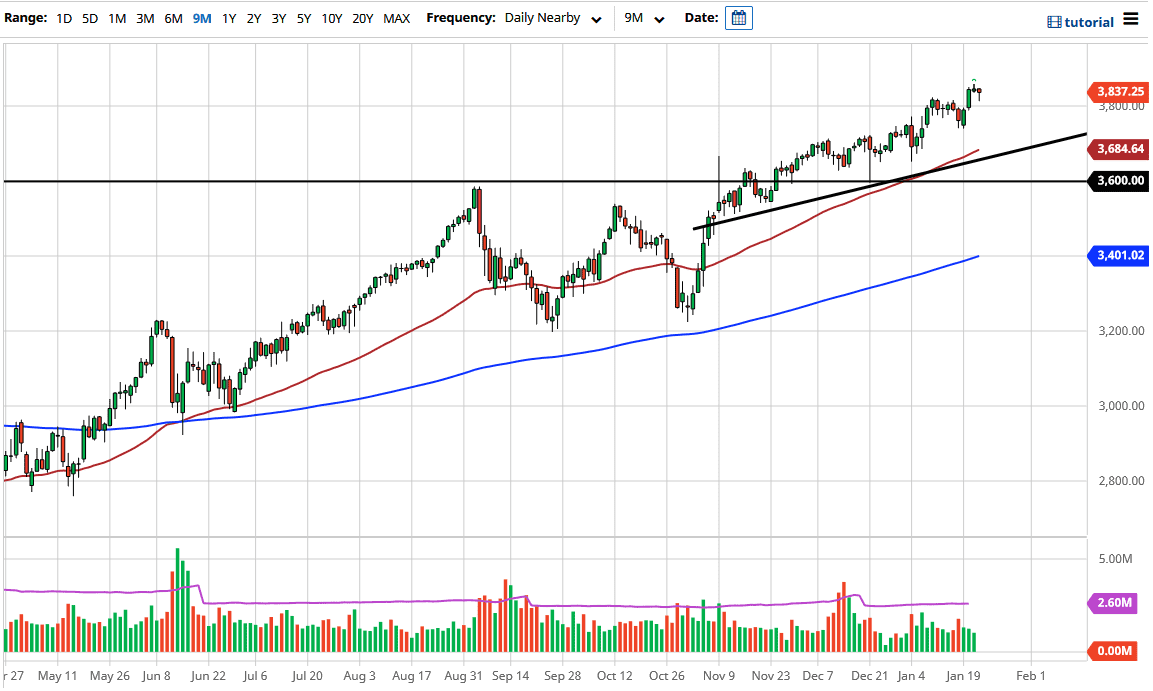

The S&P 500 fell a bit during the session on Friday to reach towards the 3800 level. We did see buyers jump in just above there, as it is an area of previous resistance. In a sense, “market memory” came into play and simple technical analysis held out. By pulling back towards the 3800 level, it is likely that buyers will be likely to see it as a bit of “value.” At this point, I think we will continue the overall trend higher and I do not have any interest in shorting.

The 3800 level is an area that previously had been resistance, and there is a lot of order flow in that general vicinity. The previous consolidation was between 3200 on the bottom of the range and the 3600 level above that had been resistance. By measuring that 400-point range and extrapolating it on a breakout, the market is looking for the 4000 handle. That does not mean that we cannot break down significantly, though, but that should only invite plenty of value hunting. The 50-day EMA sits just above the uptrend line, and if we do break down significantly, there will be a lot of people looking to get involved down there.

Do not forget, we are still very much in the midst of earnings season, which could cause a bit of noise in this market overall. That could be a significant reason to expect a lot of back and forth, but there are plenty of stimulus and money being thrown around out there to keep the markets afloat. The Federal Reserve has been trained to flood the markets with liquidity if there is anything along the lines of a sell-off on Wall Street.

If we break above the highs of the Thursday session, then it is likely we will simply continue the move higher. A lot of this is going to hinge not only on earnings, but more importantly, on the latest rhetoric when it comes to stimulus coming out of D.C. In other words, expect erratic behavior; but at the end of the day, we will go higher and look towards the previously mentioned 4000 handle.