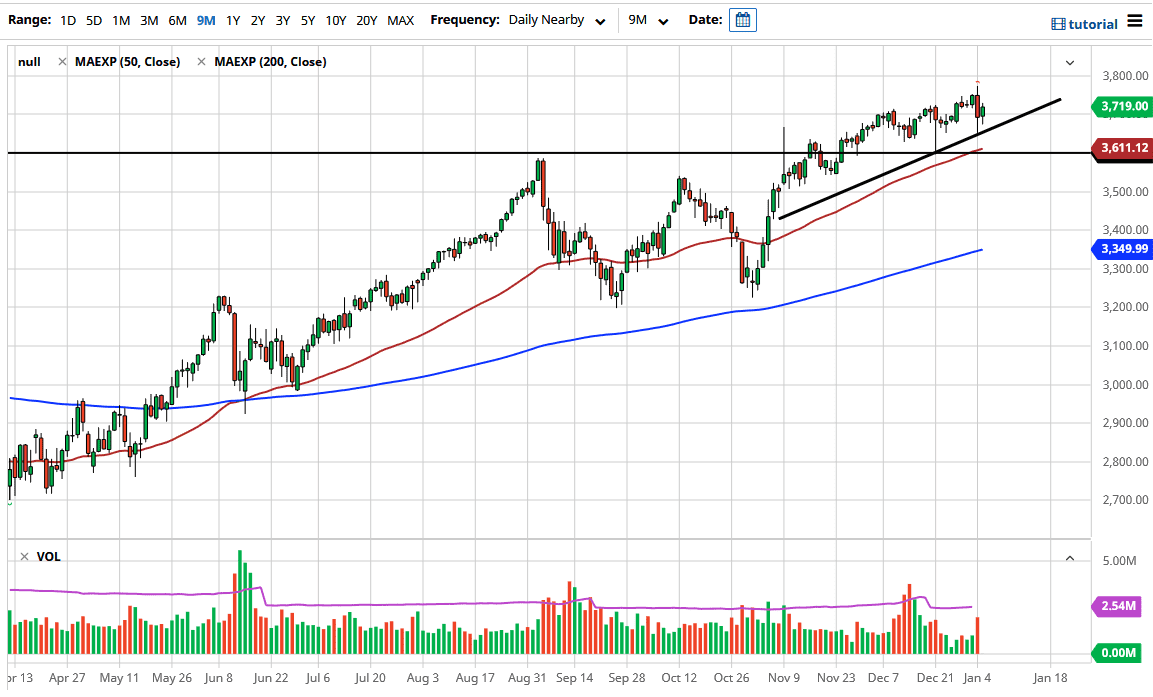

The S&P 500 initially pulled back during the trading session on Tuesday but found support underneath yet again. As we have found the 3700 level offering support, this is a simple continuation of what we have seen previously. The shape of the candlestick is somewhat like a hammer, but more importantly, we have been in an uptrend for some time. I think we will continue to find buyers on dips, because this is a situation in which stimulus will continue to push people into riskier assets. I like buying dips, and I believe that we have plenty of support underneath as well.

Looking at the chart, I also see the 3600 level underneath as massive support, especially as we have broken above that with the 50-day EMA. The 3800 level will more than likely be a target overall, as it is a rather significant handle to pay attention to, but based upon the previous consolidation area that we had been in previously, it is likely that we could see a 400-point gain on the breakout. During last year, we had been consolidating between the 3200 level on the bottom and the 3600 level on the top. By extrapolating the 400 points out, you have a target of 4000 and I think that we will get there given enough time.

While we will get to that 4000 level, there will be a lot to pay attention to. One of the biggest problems will be the fact that the Georgia Senate runoff election is overnight, and it will be difficult to see what happens next until we get results from that. At this point, the market is likely to see a bit of relief if we do get a certain amount of stalemate in the US government, which of course would be the case if the Republicans can continue to hang on to the Senate. If they do not, then there will be concerns about taxes, but I imagine it would only be a matter of time before buyers would jump in based upon the idea of stimulus. We will go higher over the long term more than anything else.