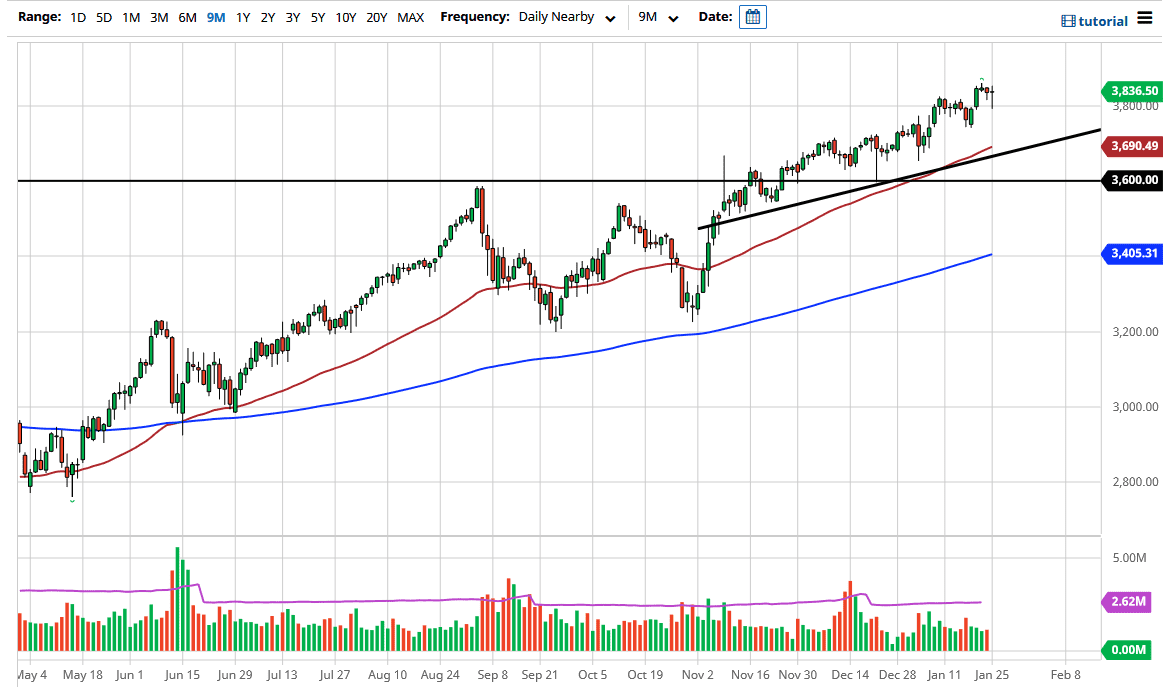

The S&P 500 fell rather hard during the trading session on Monday to test the 3800 level. The 3800 level has been a resistance barrier previously, and it should now be a support barrier going forward. The fact that we ended up forming a hammer suggests that there are still plenty of people jumping into this market every time they can. With the quantitative easing and the massive amount of stimulus that Wall Street is demanding out there, it makes sense that we continue to go higher.

The 50-day EMA has sliced through the uptrend line, which suggests that perhaps we are ready to go higher. We previously had been consolidating in a 400-point range that had resistance at the 3600 level, so it does make sense that the market would extrapolate another 400 points, reaching towards the 4000 level over the longer term. I have no interest in shorting this market due to the technical analysis, and the fact that indices only rise over the longer term. This is mainly because the Federal Reserve is going to step in and protect everybody at the first sign of serious trouble.

I believe that the 4000 level is likely due to the fact that it is a large, round, psychologically significant figure, which tends to be very magnetic for price. Beyond that, it would be an area that will have a certain amount of profit-taking involved in it as well. The market has been one that has been very steady, but we are starting to accelerate to the upside just a bit, and that suggests that we are ready to continue to go higher in general.

It is not until we break significantly below the 3600 level that I would be even remotely concerned about this market, but I think that the only way to really play the market to the downside is to start buying puts, not to actually step into the market and short it, due to the fact that the market will turn around and rip right back to the upside at the first hint of Federal Reserve intervention, which is a constant threat anytime it looks a bit soft.