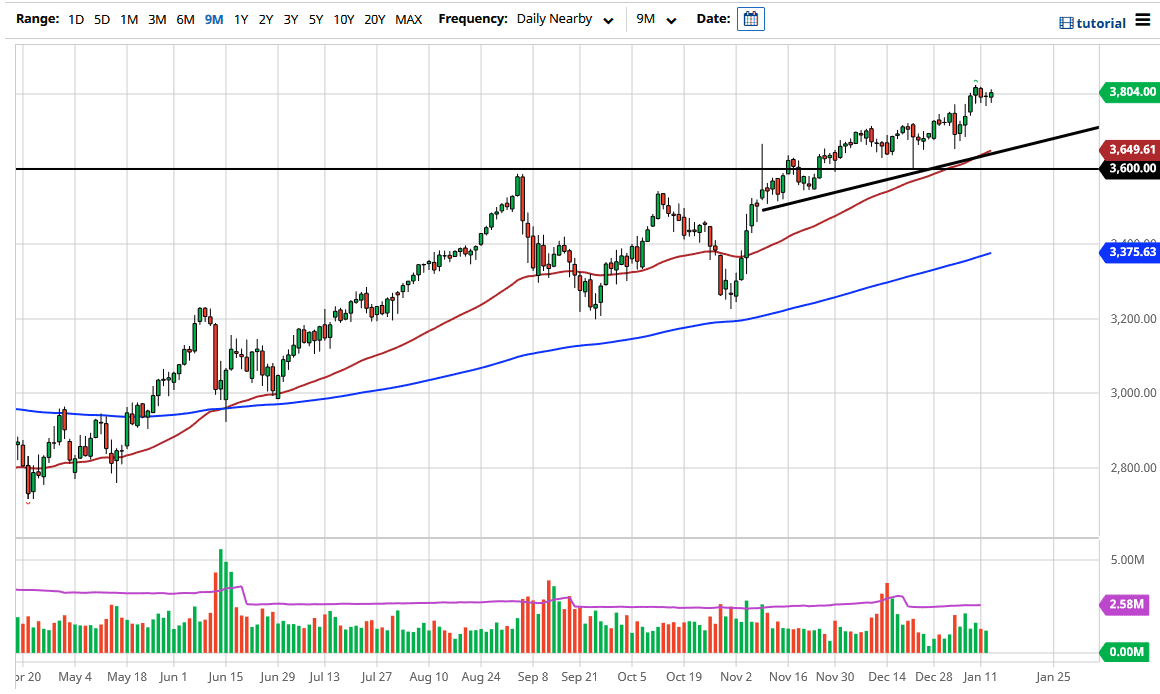

The S&P 500 initially dipped during the trading session on Wednesday, only to find buyers well below the 3800 level. The S&P 500 has been dipping every day for the last several days, but every time it drops, the market turns around to show signs of life. At this point, the 3800 level is a bit of a resistance barrier, but I think if we can break above there, then it is likely that we could go looking towards the 4000 handle.

When you look at the consolidation underneath, we had been bouncing around between the 3200 and the 3600 levels, which suggests that the 400-point move to the 4000 level is very likely. The market is likely to continue to see a lot of volatility as we head into the earnings season, but really, this is all about stimulus and more cheap/free money flowing into the right pockets. This has been the argument for 13 years, so if we do break down from here, it is likely that we will see somebody come out and bail out Wall Street from suffering significant losses. Unfortunately, this is the world that we live in, and this will continue to be a bit of an issue for anybody who looks to short the market. It is because of this that it is almost impossible to short the market, because you have only made serious gains for five times over the last 13 years. The much easier trade is to simply go with the liquidity, which is to the upside.

The markets dipping at this point in time will be looked at as a gift, as we have seen so much in the way of bullish pressure that perhaps we need to work off a little bit of the froth. However, I do think that there will be plenty of people willing to get involved, so I have no qualms whatsoever about value hunting in a market that has more or less started to rotate away from a handful of names, broadening the rally, which is actually a very healthy change in attitude. Regardless, that cheap money will continue to send Wall Street to the upside given enough time as we have seen more than once.