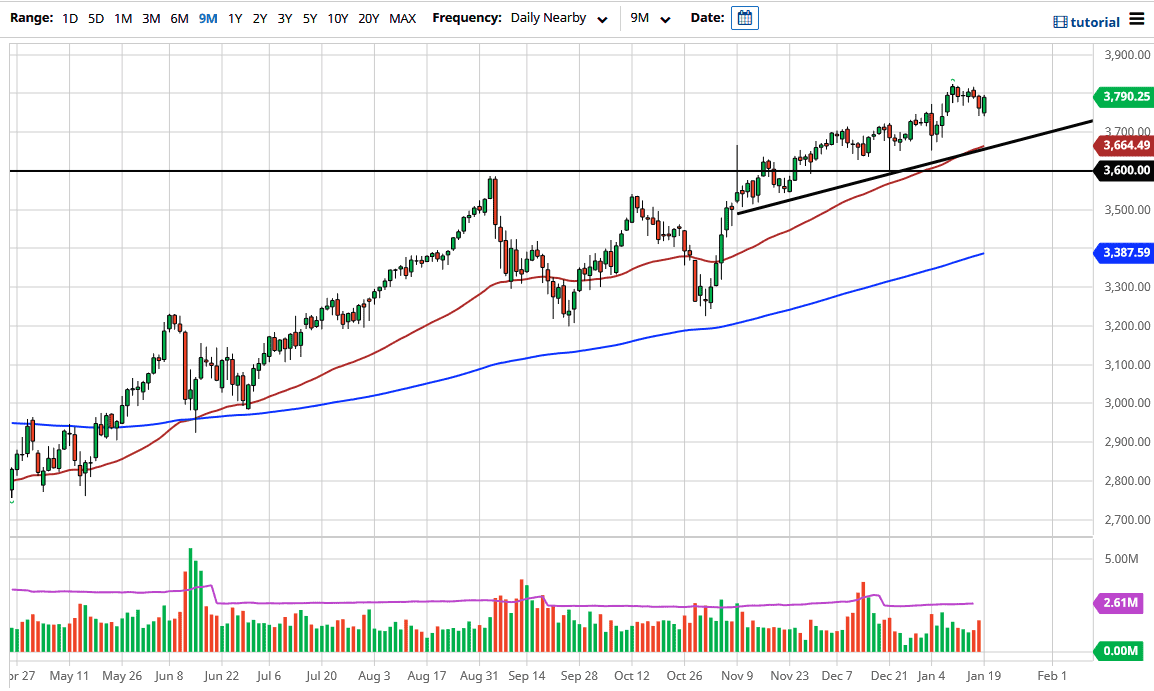

The S&P 500 rallied during the trading session on Tuesday to reach towards the 3800 level, which is an area that the market has been dancing around for some time. As we are in earnings season now, it does make sense that we would see a certain amount of hesitation to throw a ton of money into the market at any given moment anyway. The 3800 level has been important for a while, and as it is a large, round, psychologically significant figure, I think it is a magnet for price as well.

Underneath, we have the 50-day EMA reaching towards the uptrend line, which is an area that I think would be very interesting to buy near if we get the opportunity to do so. The area is roughly at the 3650 handle, and I believe that it is likely to see a lot of interest down there. After all, this is a market that love stimulus, and stimulus is most certainly coming. The stimulus will probably come in multiple phases, because the market needs it to continue going higher.

When you look at the previous consolidation area between the 3200 and the 3600 levels, it measures for a 400-point move. Now that we have broken out above the 3600 level, we should extrapolate that move towards the 4000 level. I do not think that it is going to be easy to get there, but at the end of the day that is my longer-term target. There is absolutely nothing on this chart that suggests we cannot do that. I like the idea of buying pullbacks going forward, just as I have every other time we have pulled back. As long as there is plenty of stimulus out there, then I think the S&P 500 will find reasons one way or another to go higher.

If we did break down below the 3600 level, then I think you could get a short-term selling opportunity, but I do not think that the most likely of outcomes; plus, it would also be a very short-term trade at best, considering just how strong the uptrend has been and for how long it has been going on. Look for value and take advantage of it.