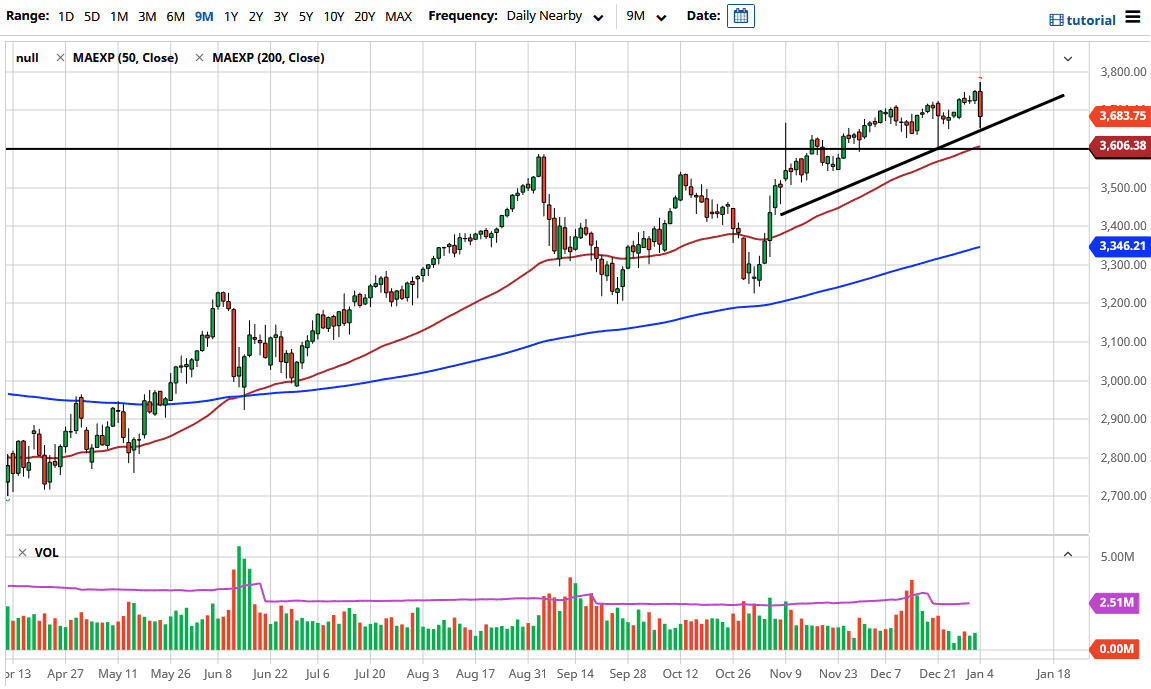

The S&P 500 initially tried to rally during the trading session on Monday but then sold off drastically, as we see many concerns when it comes to the Senate runoff election in Georgia. Wall Street is hoping that we will see the Republicans hang on to the Senate in order to deadlock some of the more left-leaning ideas that could bring in higher taxes, regulations and spending. The market has a lot to think about beyond that, not the least of which would be high valuations. Nonetheless, we are very much in an uptrend and it is ridiculous to think otherwise, despite the fact that this was a rather nasty looking candlestick.

It is only a matter of time before we find value hunters coming back into the market. The 3600 level underneath also offers support, not just the trendline that we touched during the trading session. There are plenty of people out there looking to jump into this marketplace going into 2021, but we have a lack of volume until after the jobs number, so it might be a bit sketchy. Yes, we have a lot of headline risks tomorrow, but if the Republicans can hang on to the Senate, I suspect that there will be a lot of buying because it will stabilize the entire situation.

The polls have been getting tighter in Georgia, which has people concerned, but there are so many variables that it is difficult to project going forward. Even if we do break down below here, the 50-day EMA is sitting just above the 3600 level, so that should also offer a bit of support as well. I do like the idea of buying these dips going forward, and I do not really have any interest in trying to short this market in the near term. Simply looking for value will continue to be the best way going forward, and I believe that it is only a matter of time before we go looking towards the 4000 level. I also believe that it will continue to be very noisy and choppy, due to the fact that macroeconomic situation is so uncertain.