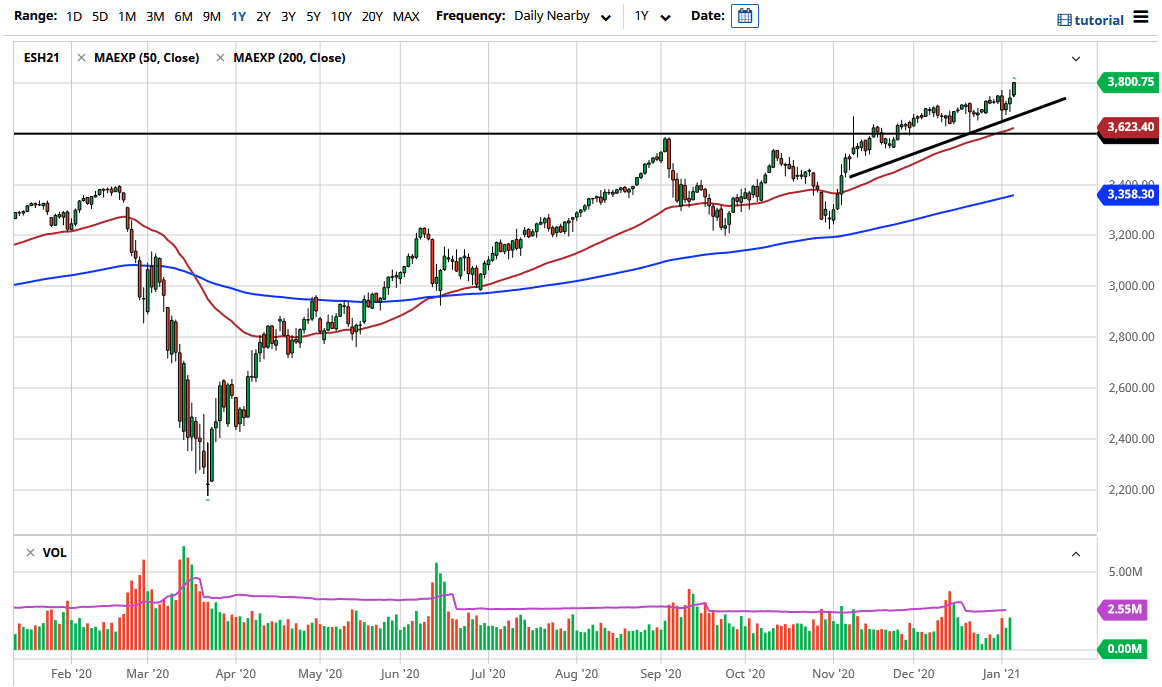

The S&P 500 has rallied a bit during the trading session on Thursday to reach towards the 3800 level. That being the case, it looks like we are going to try to break above there and grind even higher. I think given enough time, we will have buyers on dips, and as a result it is very likely that we will see value hunters every time we see dips as the market has been in such a huge uptrend. In fact, the uptrend line underneath is very supportive, and it looks like we are going to continue to see the up trending channel hold.

All of that being the case, you have to keep in mind that it is the jobs number on Friday, so it is likely to see a lot of volatility, but at this point in time I think that if we pull back is going to be nice buying opportunity and what is a very bullish market to begin with. After all, we have stimulus and a lot of free money out there, or at least cheap money, that is going to find its way back into Wall Street so therefore this market goes much higher.

Even if we break down below the uptrend line, I believe that there is a significant amount of support underneath at the 50 day EMA and the 3623 handle, and then down to the 3600 level. At this point time, I think there are plenty of reasons to think that there should be buyers in that general vicinity. On the other hand, if we can clear the 3800 level, then we could go looking towards the 3900 level followed by the 4000 level. This is based upon my projection due to the consolidation between the 3200 level on the bottom and the 3600 level on the top. Measuring that area to the upside suggests that we could go looking towards the 4000, but that does not necessarily time the market. At this point, you have to look at the idea of buying pullbacks to find value in what is obviously a one-way trade at the moment, especially now that we have all three branches in the US government going to be Democrat, which typically are quicker to do stimulus packages and spend more. The “reflation trade” continues to be the main catalyst.