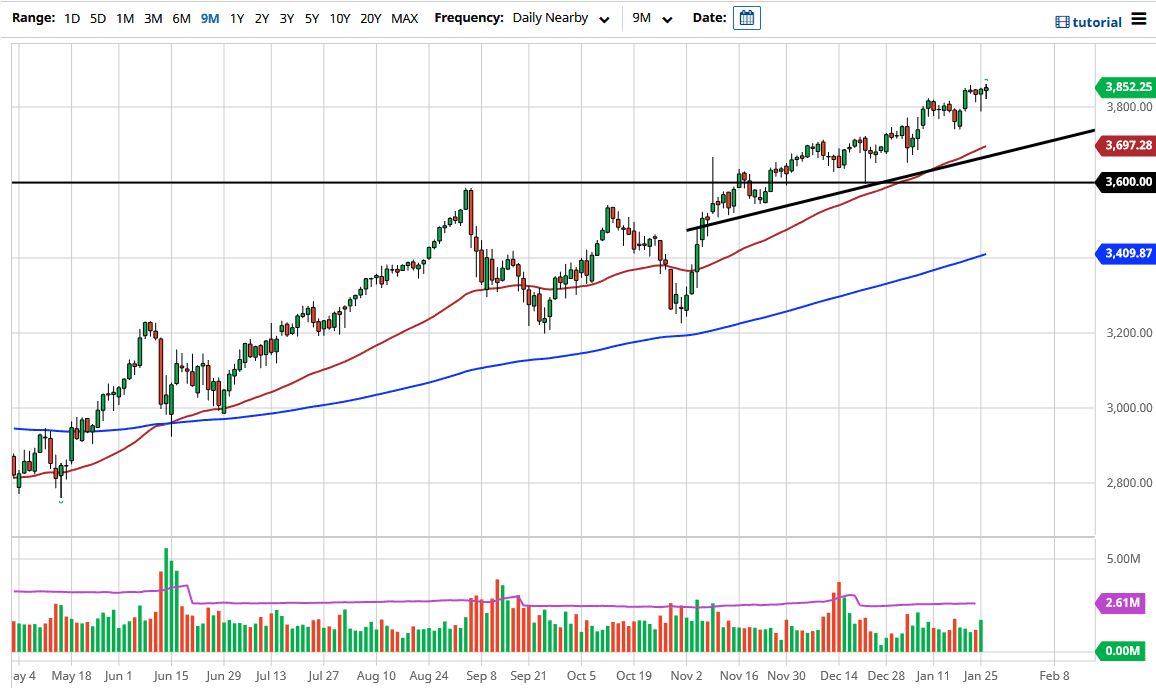

The S&P 500 initially pulled back during the trading session on Tuesday, but turned around to show signs of life again. By doing so, we have formed the third hammer in a row, suggesting that Wall Street is simply waiting for Jerome Powell to give them the green light to continue buying stocks. The FOMC meeting during the session on Wednesday will be followed by the ever-important press conference, where traders will get to hear the thoughts of Chairman Powell on the future direction of monetary policy. This is obviously very important, so a lot of traders will be looking to see whether or not the monetary policy is going to be loose enough for Wall Street to be happy.

At the end of the day, the Federal Reserve has proven more than once that it is willing to do whatever it is Wall Street needs them to do in order to keep asset prices going higher. Any pullback at this point will more than likely find plenty of buyers closer to the 3800 level, and then obviously down at the 3750 level, which was the most recent pullback, followed by the 50-day EMA, and then eventually the uptrend line. It is not unless Jerome Powell explicitly says that the Federal Reserve is going to step away from quantitative easing that I believe the market would really lose control.

It is more than likely only a matter of time before we go looking to the upside and eventually get that move higher that we have been building for some time. Again, you do not short indices in the United States; they are far too manipulated and heavily weighted towards a handful of stocks that everybody is buying. Because of this, you should look for the market to pull back to offer value and then simply take advantage of it. I have no scenario in which I am a seller of this market, which is typical for me. Longer term, I believe that the S&P 500 will go looking towards the 4000 handle, which is a large, round, psychologically significant figure that will attract a lot of headlines. Based upon the previous consolidation area, that is exactly what the measured move suggests. We are in the midst of earnings season, so it does cause a bit of noise, but at the end of the day, earnings do not matter if liquidity does.