Argentina battles the COVID-19 pandemic, being the twelfth-most infected country globally on top of its debt crisis. While many market participants dismiss the debt default and persistent debt-related issues as an outlier, many countries remain at risk of a similar path. The US leads global debt issuance and will add trillions more in 2021. Following the bullish momentum collapse, the USD/ARS remains exposed to a breakdown and sell-off.

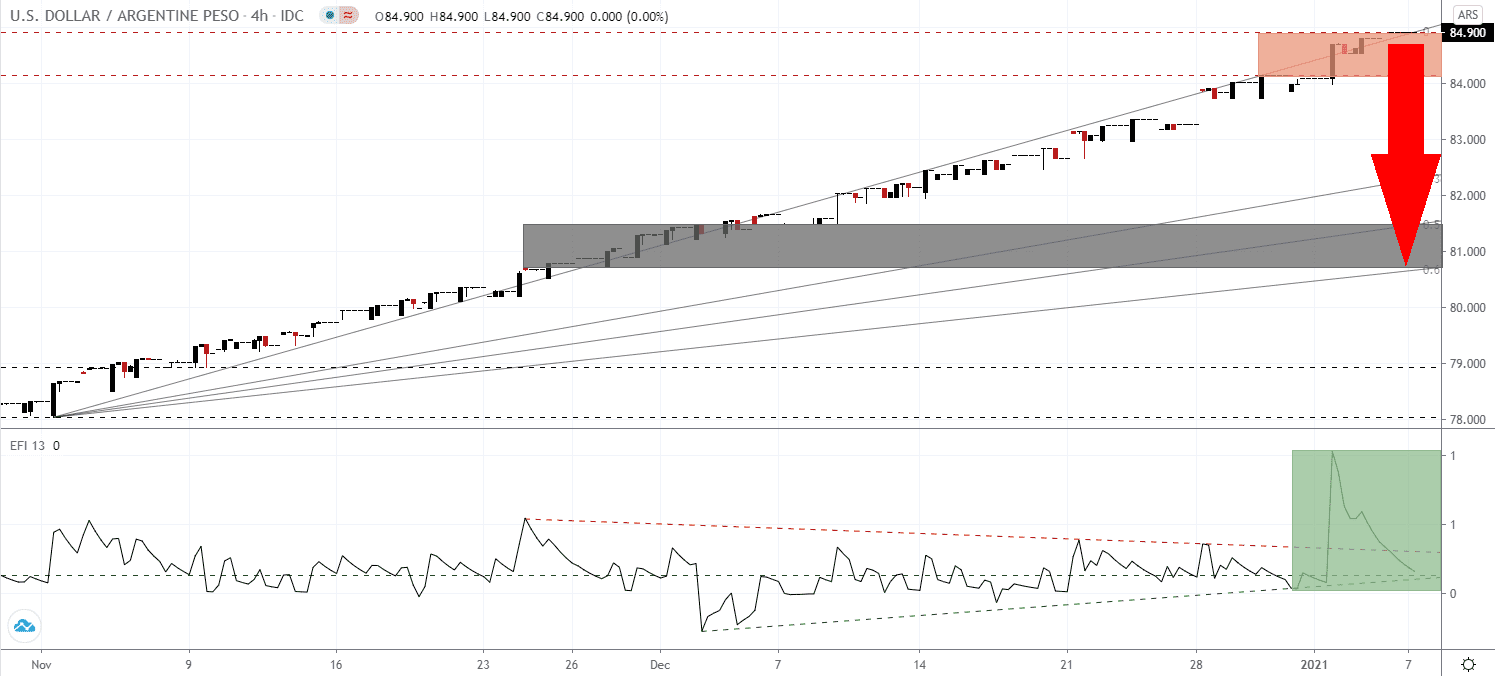

The Force Index, a next-generation technical indicator, briefly accelerated to a new multi-month peak before collapsing. After moving below its descending resistance level, as marked by the green rectangle, it is now on course to slide through its horizontal support level. A breakdown below its ascending support level will take it into negative territory, granting bears control over the USD/ARS.

After the International Monetary Fund (IMF) approved a $50 billion bailout to solve the debt crisis, protesters took to the streets. Any bailout usually comes with punishing measures that keep a country hostage for years if not decades and Argentinians voice their anger in the streets. The USD/ARS shows signs of weakness inside its resistance zone between 84.140 and 84.900, as marked by the red rectangle.

On a positive note, tax revenues for December surged 38.6% year-over-year and are up 32.1% for all of 2020 compared to 2019. Given the issues of the Argentine peso, the use of cryptocurrencies like Bitcoin continues to soar. Argentina is home to the second-most Bitcoin ATMs in Latin America. The USD/ARS can correct its linear advance into its short-term support zone between 80.690 and 81.660, as identified by the grey rectangle. It remains well-supported by its ascending Fibonacci Retracement Fan sequence.

USD/ARS Technical Trading Set-Up - Counter-Trend Correction Scenario

Short Entry @ 84.800

Take Profit @ 80.800

Stop Loss @ 85.500

Downside Potential: 4,000 pips

Upside Risk: 700 pips

Risk/Reward Ratio: 5.71

A breakout in the Force Index above its descending resistance level can lead the USD/ARS into a temporary price spike. Given ongoing bearish pressures on the US dollar, Forex traders should sell any advance from current levels. The upside potential remains limited to its next resistance zone between 85.749 and 86.178.

USD/ARS Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 85.750

Take Profit @ 86.150

Stop Loss @ 85.500

Upside Potential: 400 pips

Downside Risk: 250 pips

Risk/Reward Ratio: 1.60