The USD/ARS remains on a perilous road higher as its bullish trend remains unchecked and with no signs signaling a change of track. Speculators need to take a look at a long term chart to get a perspective regarding the value lost by the Argentina Peso since April 2018. Traders need to also understand the published government rate of the USD/ARS is artificially low; meaning within the black markets of Argentina the USD/ARS is exchanged at a much higher rate.

Buying the USD/ARS continues to be the only logical wager for speculators. In order to profit when buying the forex pair a trader needs to have patience because carrying charges overnight are almost certain to be part of transaction fees and need to be monitored. There also exist the possibility the USD/ARS could suffer a reversal lower, so risk management needs to be used. Speculators within the USD/ARS need to ask questions and read through all the rules if your broker allows you to trade the forex pair. Traders should not expect to reap profits immediately when buying the USD/ARS, time may be needed to allow momentum higher to build.

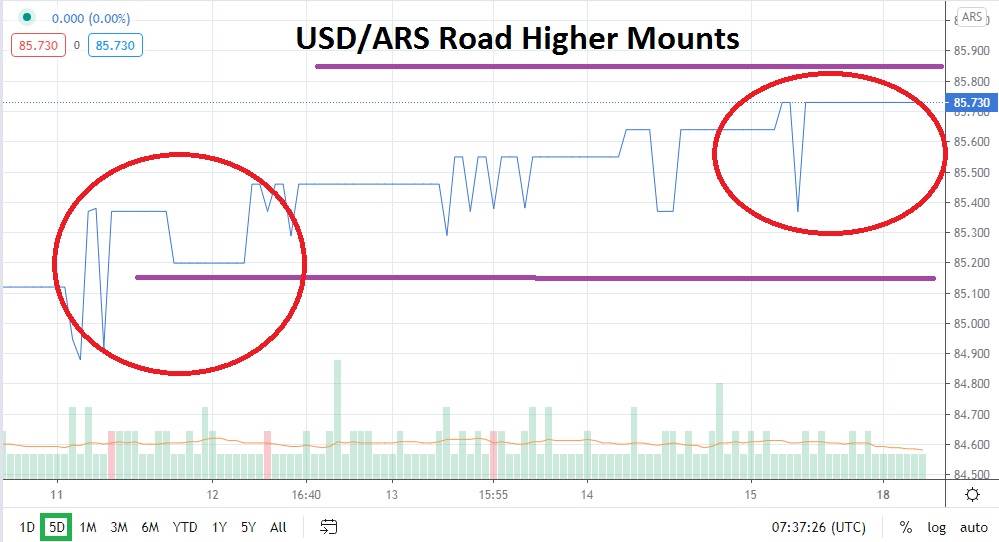

Resistance levels continue to be brushed aside with the USD/ARS. The next psychological mark ahead is the 86.000 level and if and when it falters, traders can expect the forex pair’s value to maintain its bullish path. The government of Argentina would have to achieve a remarkable turnaround of policy to create a bona fide reversal lower for the Argentina Peso, instead it appears the nation will continue to seek more international loans as it acts befuddled by the economic crisis confronting its citizens relentlessly.

Traders who want to be buyers of the USD/ARS should use limit orders to open positions, so they are not killed by price fills which may look bewildering by a lack of volume in the forex pair which can affect values. Support near the 85.250 level may prove to be adequate and perhaps this is an interesting place to put a stop loss. However, for more speculative traders a stop loss slightly below the 85.000 level may prove to be a safer bet, just in case a brief reversal lower unfolds, which also means a conservative amount of leverage needs to be used when trading.

There are no guarantees, but buying the USD/ARS remains the only logical choice for traders at this time. The upward bullish trend within the forex pair seemingly has few obstacles as the Argentina Peso slides in value against the USD.

Argentine Peso Short Term Outlook:

Current Resistance: 86.000

Current Support: 85.250

High Target: 87.000

Low Target: 85.000