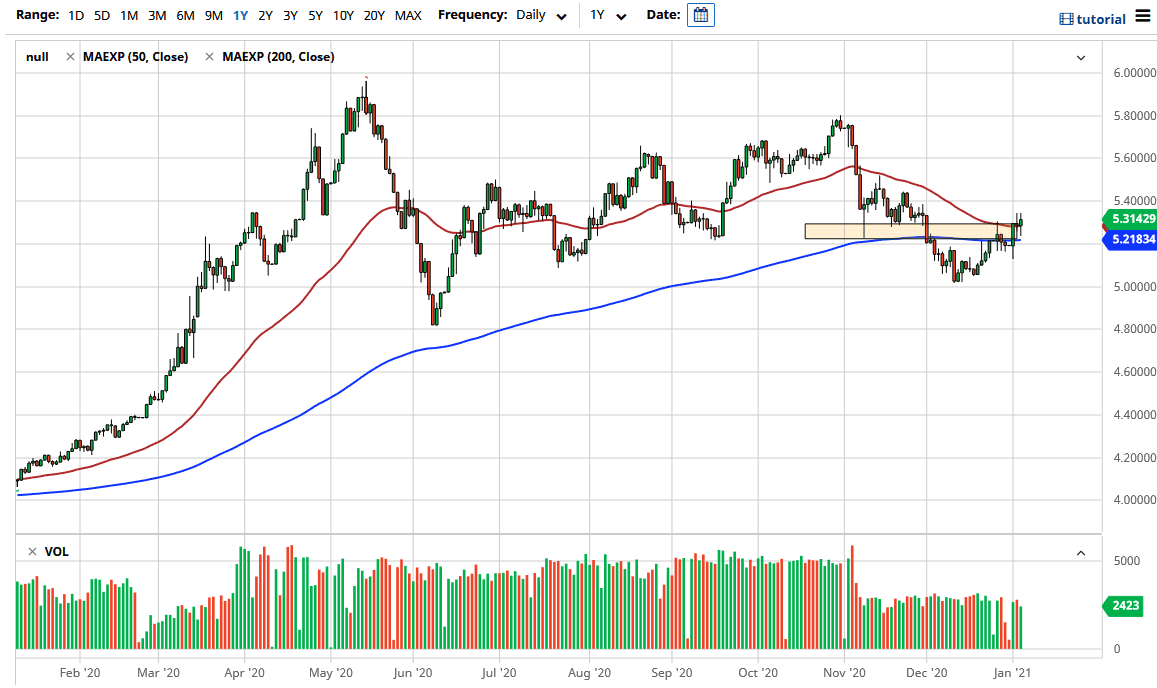

The US dollar fluctuated against the Brazilian real during the trading session on Wednesday, as we continue to bounce around the 50-day EMA. This currency tends to move right along with the other emerging market currencies, so it should not be a huge surprise that we were somewhat stagnant. After all, there are many things going on around the world that will have a massive influence on these currencies. The US dollar also has a lot hanging over it as well, so at this point a little bit of choppy behavior is warranted.

If we break down below the 200-day EMA which currently sits at the 5.21 handle, then we could break down a bit and go looking towards the 5.00 level over the long term. This is a market that tends to be very choppy, but it tends to trend for quite some time. The Brazilian real is considered to be a gateway currency for Latin America, so paying attention to the infection rate down in that part of the world will have a lot to do with what happens next with this currency pair.

Rallies will continue to see selling pressure above, not only at the 5.40 level, but also at the 5.60 level. I would look for signs of exhaustion to take advantage of due to the fact that the US dollar has been struggling for some time, and now that the Democrats run all three branches of the government, more spending is very likely. This will drive money out to look for higher returns, and commodities should come under the microscope with commodity currency following right along. Brazil is a major exporter of several soft commodities, which is something worth paying attention to. The US dollar is a safety currency, so when we get a major “risk off trade” going again, that could send the US dollar higher against the real. However, that is not the best case scenario at this point, and it looks as if the trend is trying to shift to the downside for an even bigger move. If we can break down below the 5.00 level, that could open up the floodgates for even more selling.