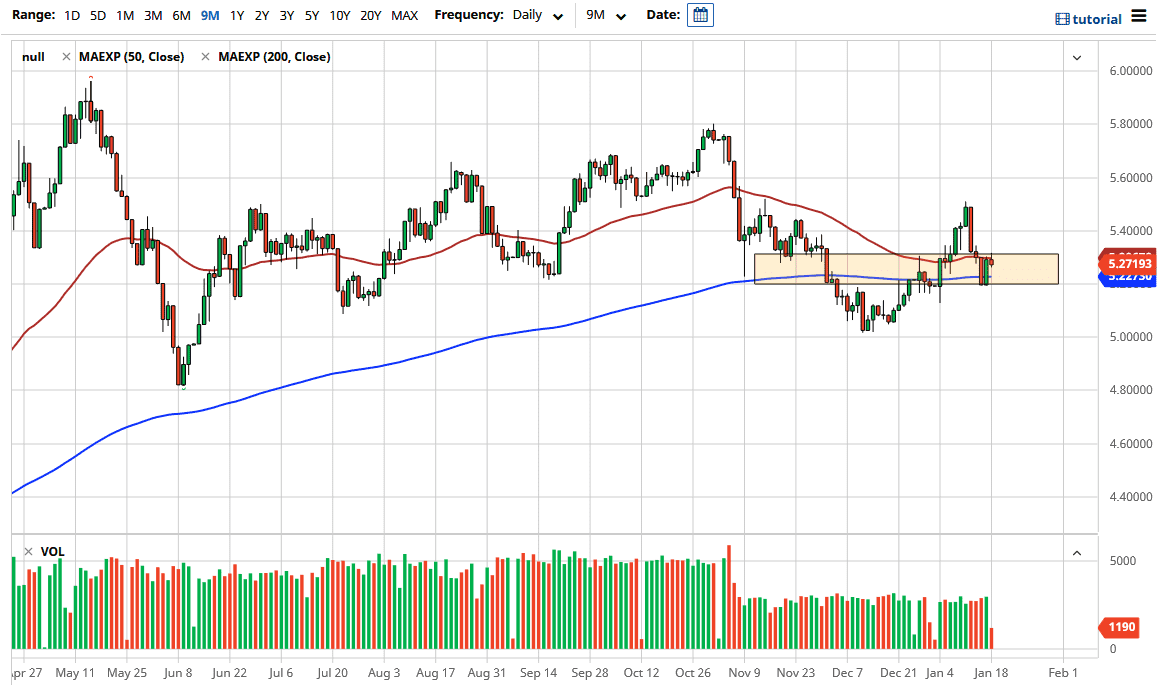

The US dollar initially tried to rally against the Brazilian real, but found enough resistance just above the 50-day EMA to turn things back around and fall. The Brazilian real will continue to be a bit interesting for those looking to try to move out on the risk curve, as the Brazilian real represents a major commodity producer. Furthermore, it is also a currency that people will use to play Latin America overall. If we get further out on the risk curve in general, the Brazilian real will finally break down below the 5.20 level and go looking towards the 5.00 level after that. That is where we had seen a major bounce, and this recent pullback could just simply be a correction that we may have needed.

If we break down below the 5.00 level, then the market is likely to continue to go much lower, moving in increments of 0.2 handles from a historical and technical standpoint. I do believe that we are still in a downtrend, but the US dollar had been oversold for a while. The Brazilian real is a favorite of mine longer term, but I think we have some work to do in this general vicinity, as the 50-day EMA and the 200-day EMA both are sitting right in this general vicinity. The last couple of candlesticks have shown a tight range, and I think we will continue to see a lot of choppiness in the short term. Long term, I do suspect that we will continue the overall negative move, but this pair does tend to be choppy and more of a longer-term type of setup most of the time.

As far as buying is concerned, I have no interest in doing so until we get a daily close above the 5.50 level, which could then open up a move towards the 5.80 level. However I do not see that happening without a major shakeup in South America or the idea of a major “risk off” type of move globally, which has people running towards the greenback. In general, you need to be very cautious about your position size more than anything else right now, but I still favor the downside overall.