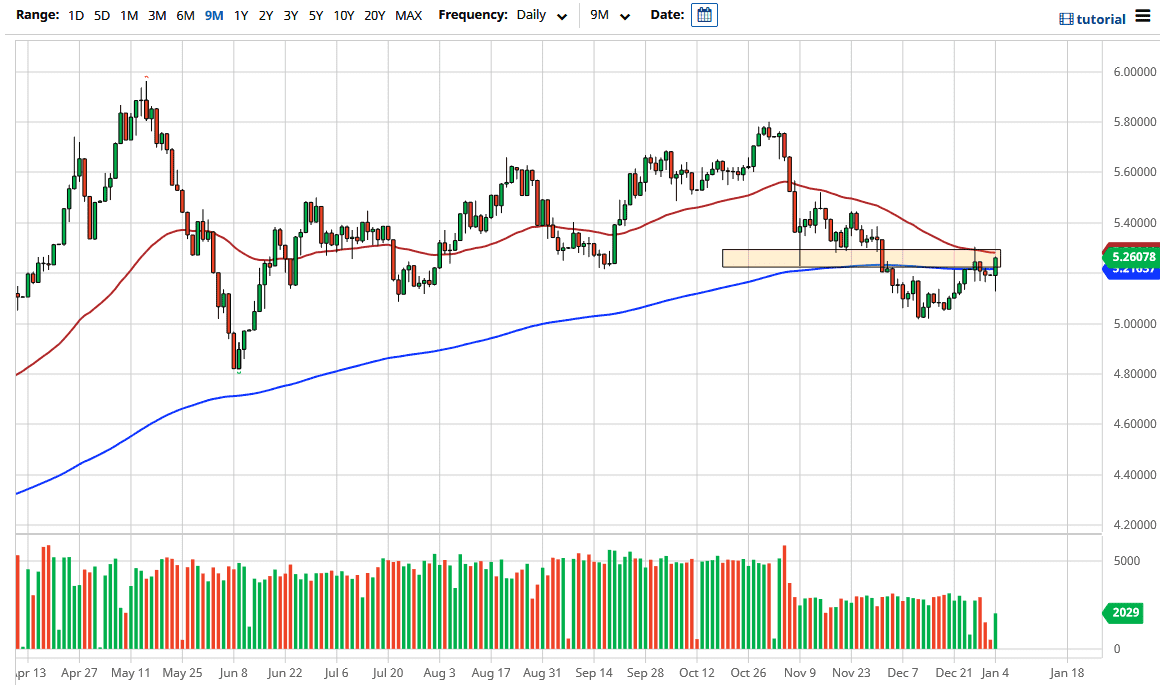

The US dollar initially fell during the trading session on Monday to plunge below the 5.20 level, before turning around and shooting straight to the upside. The 50-day EMA above offers significant resistance near the 5.30 level, so I think we have a bit of a fight ahead. The 50-day EMA is not a “brick wall”, but it suggests that there should be selling pressure in this general vicinity. There is even more resistance at the 5.40 level, which is an area that has seen quite a bit of selling pressure previously.

The Brazilian real will continue to be very noisy, but we have been in a downtrend for some time, with quite a bit of negativity, despite the fact that it was so bullish during Monday. I think at this point in time the US dollar could continue to sell off given enough time, perhaps reaching down towards the 5.00 level underneath.

Even if we do break higher than the 5.40 level, I think the 5.50 level would be a large, round, psychologically significant figure, and an area where we have seen a lot of selling pressure, as well as buying pressure, previously. I am simply looking for a sign of exhaustion to take advantage of this market so that I can continue to sell what has been very negative price action until the last week or so. With this, I do believe that the Brazilian real does have a little bit of risk built into it due to the coronavirus figures in Latin America, but given enough time, the vaccine will be reason enough for people to start looking towards the other side of the pandemic. That typically means that the trading community will be looking for growth, with the idea that eventually things will “go back to normal.” This market is one that I have no interest in buying anytime soon, due to the fact that it does tend to be rather choppy, and the interest rate differential could be a factor as well. Pay attention to the US Dollar Index because it has bounced nicely during the trading session on Monday, but it is also extremely depressed at this time.